A Biden Administration is a “Good Time for a Fresh Start” on Digital Assets

With a new President in the White House, the digital assets industry will have another chance to re-engage with regulators and lawmakers according to panelists on a recent Blockworks seminar. Highlighting incoming SEC chair Gary Gensler’s experience in industry and academia, […]

key takeaways

- Panelists on a recent Blockworks webinar agree that a new administration in the White House will be a chance for a fresh slate between the crypto industry and regulators

- Coinbase’s IPO will force regulators to take a more decisive stance on security rulings

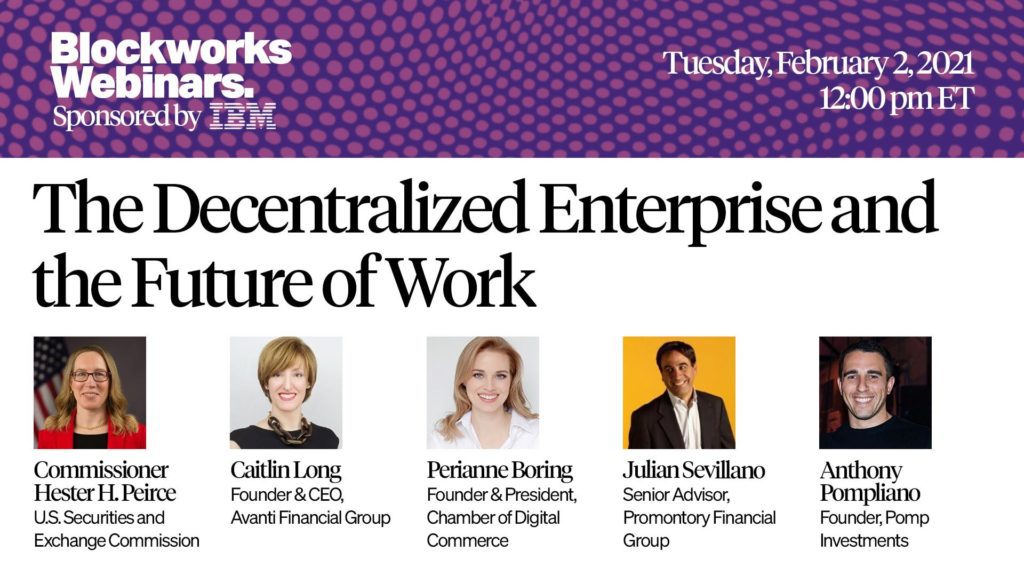

With a new President in the White House, the digital assets industry will have another chance to re-engage with regulators and lawmakers according to panelists on a recent Blockworks seminar.

Highlighting incoming SEC chair Gary Gensler’s experience in industry and academia, SEC commissioner Hester Pierce said it would be a “good time for a fresh start” on how regulators approach digital assets.

“Given his knowledge of the area and the developments that have happened in recent years, it’s really incumbent on a new SEC chairman to take a fresh look and think about how we’ve approached the issue,” Pierce said during the webinar. “It’s time to look at some of the developments in the space, and react with regulatory clarity.”

Pierce has been a frequent dissenter to SEC rulings that block bitcoin-related funds from entering the market, or that seek to apply the Howey test, a determination of what is and is not a security, to token projects. In an interview last year, she previously argued that there needs to be some “soul searching” on whether a 1946 court ruling is best applied in the current era.

She has also been a frequent critic of the SEC’s habit of legislation through enforcement, which can be industry-killing. She pointed to the bursting of the 2017 ICO bubble as an example.

“Crypto deserves a regulatory framework that’s fit for it,” she said.

Perianne Boring, who runs the Washington, D.C.-based Chamber of Digital Commerce, added that a new administration should change the “tone and tenor” of digital asset policy in the U.S. which she believes is too focused on enforcement and not innovation.

“Of course there’s risk to this technology, there’s risk to any technology,” she said. “But there are also massive benefits from an economic, jobs, and national security perspective. We should figure out how to foster this technology to ensure that the benefits are realized in the U.S.”

“Digital assets aren’t a Republican vs. Democrat thing. It’s about financial inclusion. Everyone can agree upon it,” added Julian Sevillano, Senior Advisor at IBM’s Promontory Financial Group.

2021 will be the year of regulatory clarity for digital assets

As institutional demand for digital assets accelerates, one thing holding back further adoption is a lack of regulatory clarity by the SEC — particularly the perennial debate of what is and isn’t a security.

Caitlin Long, Founder and CEO of Wyoming-based crypto bank Avanti, said that there are two major regulatory events to look for this year: Coinbase’s IPO and the Fed’s review of two crypto-bank applications.

Long said that one of the side effects of Coinbase’s IPO will some regulatory clarity on what is and isn’t a security thanks to the intense scrutiny of the company’s S-1 filings.

“The practical impact of this is that if there’s something trading on Coinbase that is a security, and the SEC thinks it’s a security, it probably won’t be trading on Coinbase by the time it goes public,” she said.

The SEC’s review of the Coinbase IPO will finally bring some clarity to some of the questions that haven’t been answered yet like what is the status of a stablecoin, as she said that it will be de-facto answered directly or indirectly as a result of the Coinbase IPO.

After the Coinbase IPO comes the two applications from crypto banks waiting before the Fed for payment system access. The Fed has never opined on digital assets (only the SEC has), and its opinions that will come out the application are sure to bring clarity for the crypto industry.

“This clarity will be positive for the industry. Although, there’s bound to be some surprises: I’m sure it won’t be a straight line but rather a zig-zagging line,” she said.