Altcoins Tread Water as BTC and ETH Fail to Catch a Bid: Markets Wrap

BTC and ETH bearish price action are contributing to a broader market sell-off of altcoins, Bitcoin derivatives open interest retraces

Source: Shutterstock

key takeaways

- Altcoins are getting hit hard as BTC and ETH fail to garner positive momentum

- The reduction in derivates open interest for BTC can be viewed as a silver lining

BTC and ETH struggles fuel large altcoin sell-off.

BTC market structure looks healthier than the May 2021 correction.

Futures open interest and perpetual funding rates for BTC have retraced to healthier levels.

ETH has lost key areas of support but may prove to outperform in the next bear market by being a more productive asset than BTC, according to some industry experts.

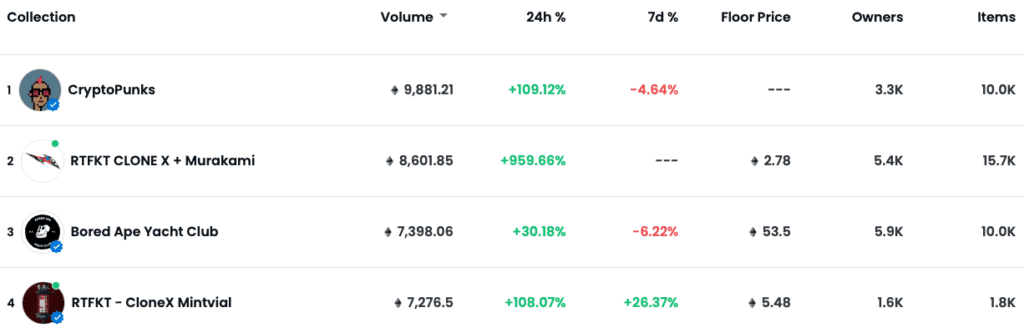

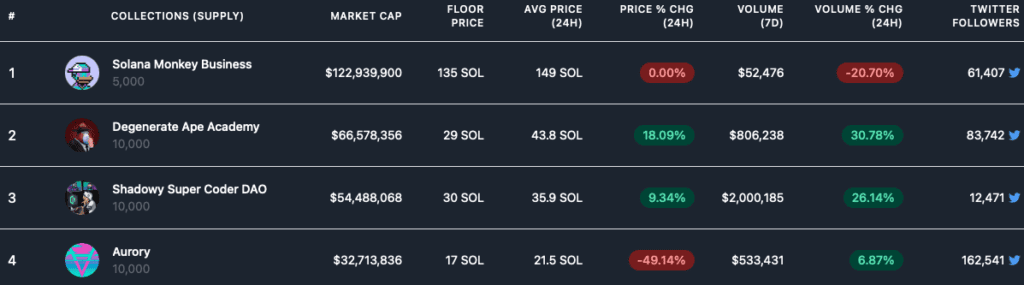

NFT floor prices have risen over the last 24 hours, but this is likely due to the price correction in the assets they are denominated in, i.e. ETH and SOL.

Latest in Macro:

- S&P 500: 4,668, -0.91%

- NASDAQ: 15,413, -1.39%

- Gold: $1,786, +0.19%

- WTI Crude Oil: $71.24, -0.60%

- 10-Year Treasury: 1.414%, -0.075%

Latest in Crypto:

Altcoins getting hammered

Altcoins are treading water on the heels of weakness in BTC and ETH price action. Market sentiment is poor according to alternative.me, with the crypto fear and greed index sitting at 28. The benchmark is on a 100-point scale where 0 indicates fear and 100 indicates greed.

BTC is seen as one of today’s ‘top gainers’ according to data from laevitas.ch, despite being down roughly 7.5% over the past 24 hours. BTC dominance, or the percent of the total crypto market cap that BTC comprises, is up approximately 1.10% according to data from TradingView.

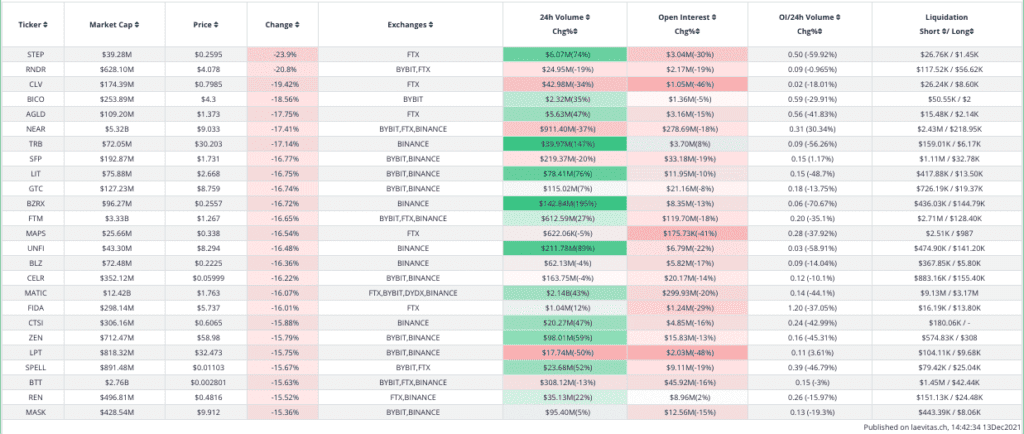

The top 25 losers over the past 24 hours can be found in the table below provided by laevitas, showing that altcoins are taking the recent dip especially hard. Some coins have seen their market caps drop by nearly 25%.

BTC today vs. May 2021

After trading north of $50,000 last night, BTC has since corrected and briefly traded below $46,000 according to data from coinmarketcap.

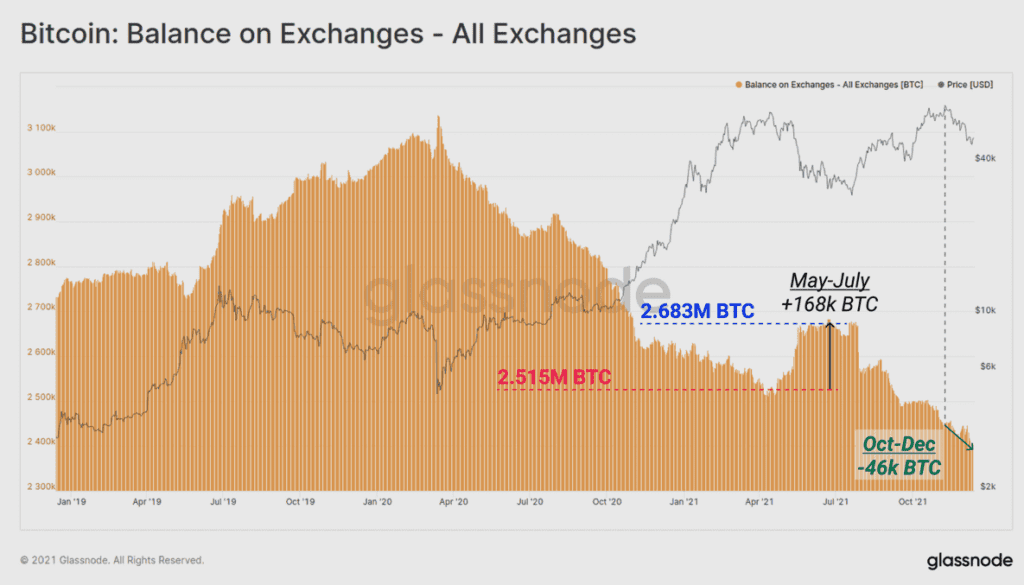

This correction shows different patterns in BTC exchange flows when compared to the correction in May of 2021, according to a Glassnode report. Between May and July roughly 168,000 BTC were moved onto exchanges signaling long-term holder selling. The correction is seen from the end of October through today, more than 45,000 BTC has moved off of centralized exchanges signaling investor accumulation.

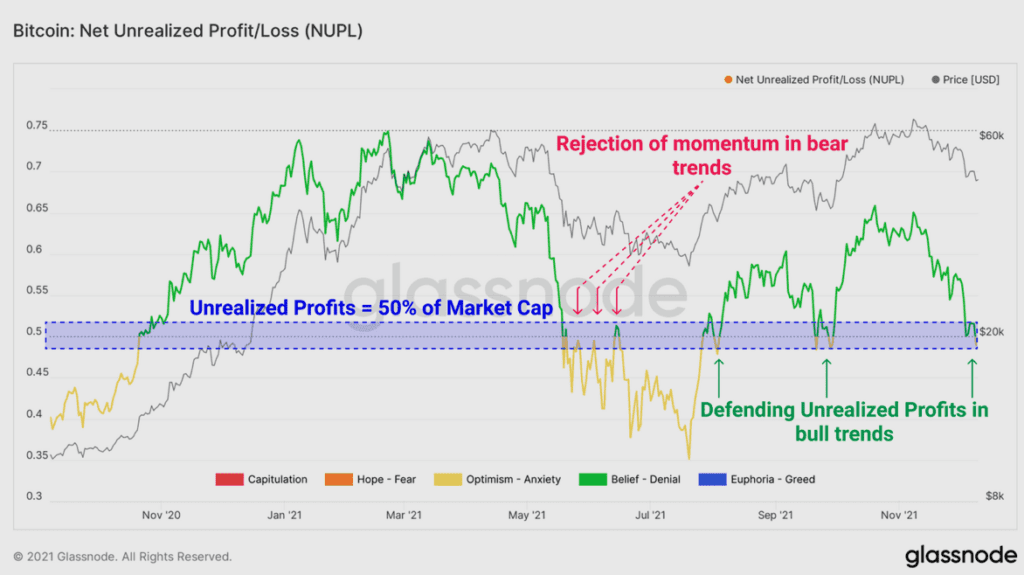

Net Unrealized Profit/Loss (NUPL) provides a gauge for how much of the BTC supply is being held in unrealized profit or loss. 50% has historically been a battleground for the bulls versus the bears.

“Per this chart, the current leg down in price seems to resemble a correction within a larger bull trend – a stark contrast to May where NUPL sliced cleanly through the 50% level,” states the aforementioned Glassnode report. “It is possible that this trading range is defining the bull-bear line in the sand, and a key risk is whether a possible transition into less favorable conditions occurs should it fail to hold.”

The BTC NUPL was unable to hold the line during May, which led to further downside. It remains to be seen whether the bulls can hold the line this time around.

BTC derivatives

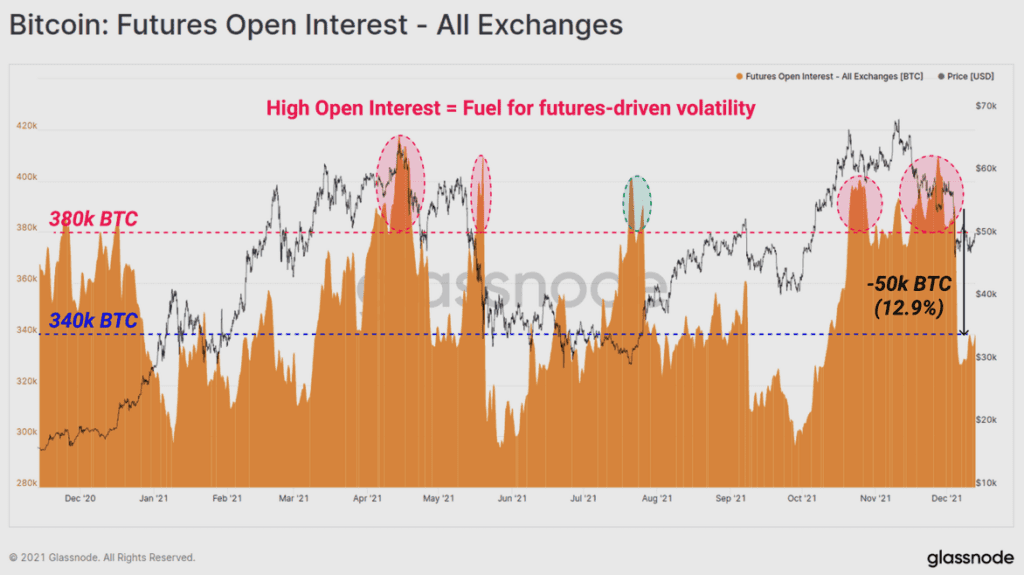

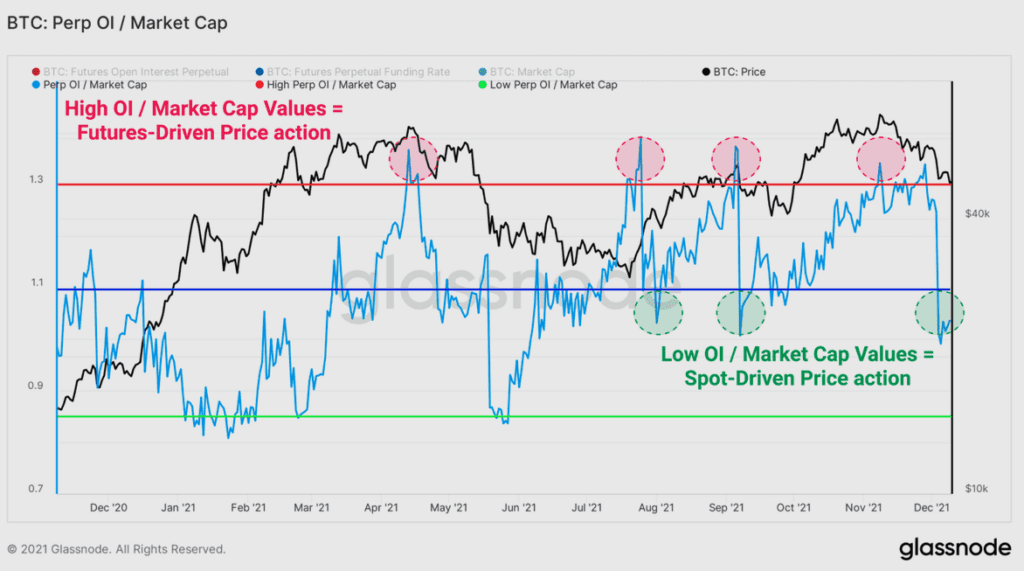

The current BTC market structure and tomorrow’s FOMC meeting make for a shaky outlook for price action, but one silver lining is the reduction in open interest in the derivatives market.

A high amount of futures open interest increases the possibility of a large move where traders have their short or long positions wiped out. “This influence of futures markets on price is particularly dominant during periods where Futures Open Interest climbs above the 380k BTC level,” states the Glassnode report.

Futures open interest has declined to healthy levels and has yet to spike back up as seen in May of 2021 before the correction below $30,000. Data from laevitas.ch shows perpetual funding rates are only slightly positive, which reaffirms the notion that there is less aggressive dip buying in the BTC derivates market.

Another note in relation to perpetuals includes the decline in open interest compared to the BTC market cap. When this ratio is declining, the market is more heavily spot-driven and less dictated by the derivatives market, according to Glassnode.

The recent correction saw a healthy leverage washout, but not as drastic as the one seen in May of 2021. This tells investors that while a lot of leverage has been wiped out and the market is being more heavily influenced by spot demand, a grind lower could still lead to more liquidations and a volatile movement to the downside.

Ethereum note

ETH has been making lower highs and lower lows in recent weeks, which is seen as a bearish market structure. It has also lost the previous closing high seen in May of 2021, which reaffirms the bear case.

On a positive note, some prominent investors in the space believe that the next crypto bear market will be more kind to productive assets or assets that provide a yield, such as ETH, and be harsher on non-productive assets such as BTC.

“A small percentage of capital in the world is non-productive. Fiat cash is ~$100T and Gold is ~$10T. Public and private equity, debt, and real estate are at least 100x larger,” wrote Kyle Samani, co-founder of Multicoin Capital. “The world actually does not care about non-productive assets. This is why I expect SOL and ETH to substantially outperform BTC through the next ‘bear market’. The tech money doesn’t care about macro. They just want to be long the stuff that they think is going to change the world”.

Non-Fungible Tokens (NFTs)

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.