An SEC lawsuit against OpenSea may be on the horizon

Plus, if the SEC really does sue OpenSea, then it would be over two years too late

Tada Images/Shutterstock modified by Blockworks

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Wells, wells, wells

The SEC’s apparently mulling calling NFTs — or secondary sales of NFTs — securities.

Actually, to be completely fair, we really don’t know what they’re thinking.

What we do know, though, is that they’ve wrapped up an investigation into OpenSea and a potential lawsuit may be on the horizon, per a Wells notice that the company said it received.

Suppose the SEC follows through and actually engages the NFT platform in a legal battle. In that case, it won’t necessarily be the first time that the regulator tries to claim that NFTs also count as securities (alongside a long list of tokens, though — as we’ve discussed — they’ve gotten plenty of pushback against that).

Still, it will be the first time that the firm they’re targeting for NFTs actually fights back.

Both Impact Theory and Stoner Cats settled with the SEC after the regulator claimed they violated securities laws with their NFT projects. In another case, the Department of Justice went after a former employee for insider trading, which could perhaps also imply that the things, aka NFTs, he was trading were, well, securities.

Jason Gottlieb, who’s representing Jonathan Mann and Brian Frye in their case against the SEC (in which they’re trying to suss out regulatory clarity around NFTs), said that he expects the agency to fall back on the settlements if they bring a case against OpenSea.

“Where I think this precedence gets dangerous is the SEC has this immense power where it can come in against smaller projects or artists, and say, ‘we think that you’re violating the securities laws, we’re going to sue you, and if you want to fight us, you’re going to spend millions of dollars, and you’re going to spend the next few years locked in litigation.’ And frankly, most people can’t afford to do that,” Gottlieb explained.

Pillsbury Winthrop Shaw Pittman partner David Oliwenstein also expects the former settlements to crop up.

“It is likely that the SEC will rely on the Impact Theory and Stoner Cats matters to bolster their argument that — depending on how the Howey analysis applies to a particular asset — NFTs may constitute ‘investment contracts’ under the federal securities laws. It will certainly use those enforcement actions to counter any argument by OpenSea that the exchange lacked ‘fair notice’ that the SEC views NFTs as securities,” he told me.

But the DOJ case I mentioned? Despite being headlined as an insider trading case, the DOJ didn’t actually target securities fraud. So, despite the use of the term insider trading — Oliwenstein doesn’t expect the SEC to try to use the case against OpenSea unless it shows “compliance failures by the exchange.”

To circle back on Gottlieb’s comment, OpenSea seems quite aware that the SEC may now target smaller projects. Buried in the Wells notice disclosure from yesterday was a pledge from the platform to aid NFT projects facing SEC action. The company says it has allocated $5 million to that fight, as it prepares its own legal battle.

Gottlieb pointed out that there’s mud in the water when it comes to a potential case. So far, the SEC hasn’t been necessarily winning on its arguments that secondary market trading of the tokens it has alleged are securities. In the Kraken case, as we discussed earlier this week, the judge allowed the case to stand based on some of the securities claims, but also showed a fair bit of skepticism.

Judge William Orrick said that the SEC had an “inconsistent manner” when discussing digital assets, and tacked on that the agency sometimes “confuses” its case with the claims it’s making.

Add to that, Gottlieb said, the fact that NFTs don’t have the same argument as, say, the tokens mentioned in some of the previous cases brought by the SEC.

Potentially claiming that there’s a difference between digital art and what we’ll call real world art (the OG RWA, if you will) enough to call the former a security is a “really troubling precedent,” Gottlieb explained.

The SEC, if it wanted to pursue this argument, could have feasibly alleged that all art is a security, going back so far as the regulator’s inception. But it hasn’t, he noted.

“So for the staff of the SEC to be threatening charges against OpenSea both lies in the face of what judges have said about secondary market trading of tokens, but is also flying in the face of 90 years of history where the where the SEC does not regulate art markets,” Gottlieb told me.

To add to this, OpenSea’s been operating without SEC fanfare since 2017. While I can’t stress enough that the only folks who know what the SEC plans to do are the ones at the SEC themselves, this case could open yet another can of worms for crypto.

— Katherine Ross

Data Center

- BTC is flat and ETH is up 1% over a quiet day for markets. (BTC: $60,200; ETH: $2,560.)

- HNT leads the top 100 with 8% gains, followed by FLR and TON with around 3% each, per CoinGecko.

- TON is still down over 14% in the past week, with support above $5 holding for now.

- ETH’s supply is on track to increase by $2 billion over the next year at current usage rates.

- Daily BTC transfer volumes are at their highest in at least three months, hitting around $60 billion this week, according to Blockworks Research data.

Gensler is late again

If the SEC really does go ahead with suing OpenSea, then it would be over two years too late.

Putting aside the merits (or lack thereof) of a case against the firm, most NFT activity happens elsewhere these days.

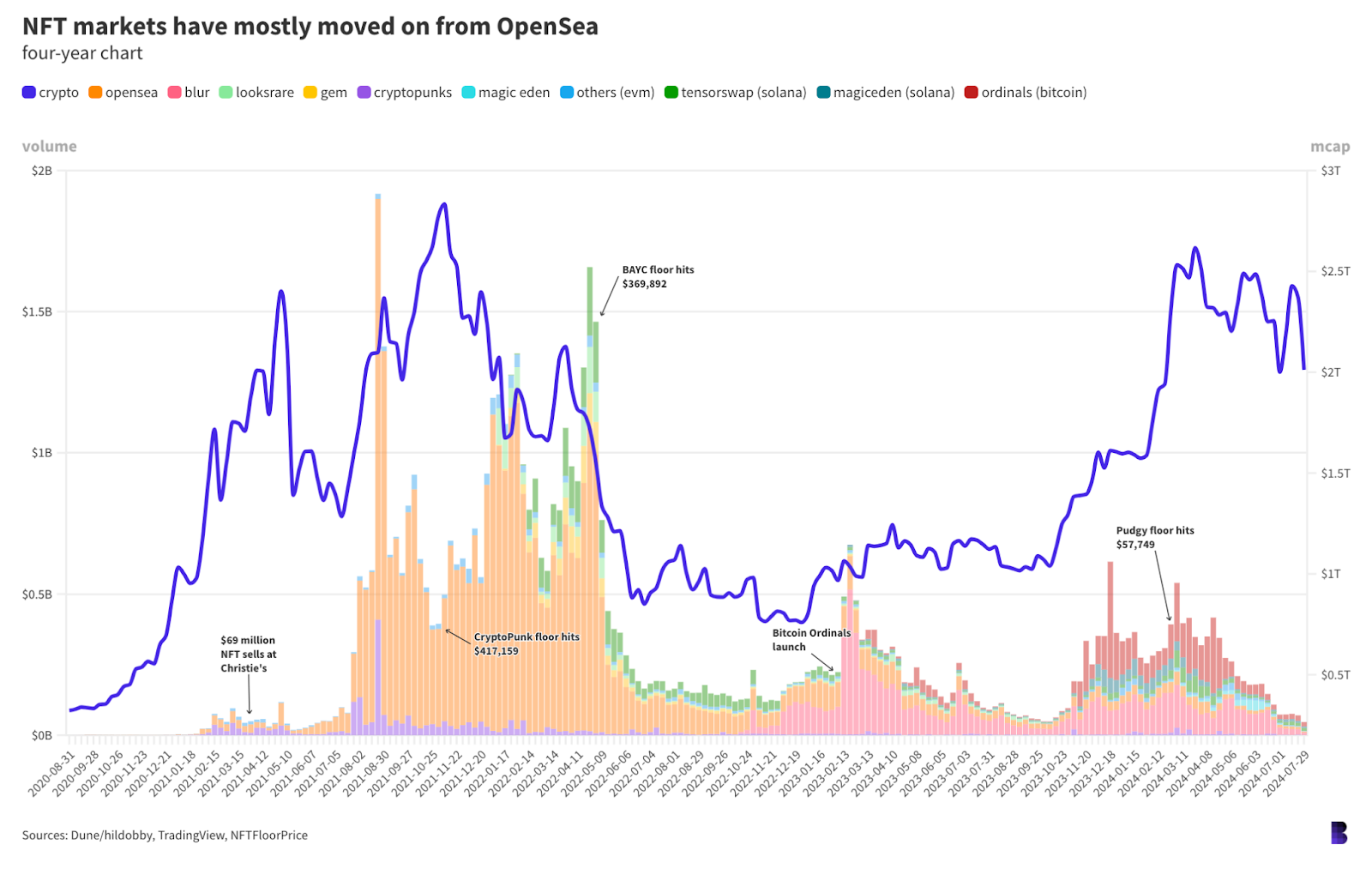

The chart below plots US-dollar denominated trading volumes for NFT marketplaces on EVM chains, shown by the colorful columns in the background. Crypto’s total market cap is otherwise reflected by the blue line.

It includes NFT trades on Ethereum, Base, Blast as well as Solana and Bitcoin, over the past four years.

(EVM data was sourced from this Dune dashboard by user @hildobby, and from here for the Solana volume. The Bitcoin data came from CryptoSlam. Both filter out volumes suspected to be the result of wash trading, so actual onchain volumes are higher, but this should reflect organic trading activity for most of the NFT market.)

The data points to over $62.75 billion in NFT trade volumes since August 2020, with OpenSea facilitating nearly 58% of it.

A look at just the past year shows a total of $11.37 billion in NFT trading volume. OpenSea, based in New York, only contributed 10% of those trades.

Blur alone processed $3.75 billion, about one-third of the total, while Solana marketplaces Tensorswap and MagicEden made up 6.6% and 8%, respectively.

And if we bundle all Ordinals trading under one umbrella, $3.8 billion in Bitcoin-native collectibles were traded in the past year (up until the start of August) making up almost 34% of yearly volume. Ordinal volumes are shown in the dark red columns on the chart.

NFTs have long been an easy target for haters. Barring the more ridiculous use cases — from burning artworks to tokenizing farts in jars — even the most popular NFT markets are usually much less liquid than top fungible cryptocurrencies, not to mention much smaller.

This usually makes them far more prone to mini bubbles and other kinds of manias. Which draws a lot of attention, both positive and negative.

But what I suspect is really happening is that NFT markets are following their own cycle schedules, potentially separate from the rest of the crypto market.

NFTs have only been traded with any real size for three years, with its largest cycle to date mostly occurring within the first.

Blur (in coral pink on the chart above) reignited some of the fire when it launched late 2022. Bitcoin did it again through Ordinals. And while those volumes have recently dried up, sillier things have happened in crypto than NFTs finding sustained market interest.

Unless the SEC ruins the fun for everyone, that is.

— David Canellis

The Works

- Meanwhile, former President Donald Trump’s fourth NFT collection raked in $2 million.

- Telegram CEO Pavel Durov was officially indicted in France.

- Venture capitalists invested in Toncoin are assessing the risks of their investments following Durov’s arrest and subsequent indictment, Bloomberg reported.

- Binance CEO Richard Teng denied allegations that the exchange had seized Palestinian funds at the request of Israeli armed forces.

- The CEO of a South Korean crypto firm was stabbed in the neck during his fraud trial, Reuters reported.

The Riff

Q: Is the SEC still crypto’s number one hater?

It definitely has rivals.

Take these recent survey results. Crypto is the second-least attractive “male nerd hobby,” second only to Funko Pops. Over twice as many women considered crypto unattractive than building models.

And then there’s a study coming out of the University of Toronto that found “crypto holders display lower levels of analytic and scientific thinking and are likelier to exhibit psychopathy than the general population,” per economist Steve Hanke, long-time crypto derider.

And then there’s the total rejection of anything crypto from gamers, which doesn’t seem anywhere near resolved.

Do any of those cohorts represent a bigger hater than the SEC? In terms of their overall contribution to the mainstream zeitgeist, I’d say yes, which is a scary thought.

— David Canellis

Is there even any question? Of course.

What I wouldn’t give to be a fly on the wall to better understand the SEC’s approach to all of these legal fights… but alas, I’m no animorph.

Instead, I’ll settle on looking at what we’ve seen this year alone. The SEC hasn’t, perhaps, been as active as last year but it’s clearly still ready to act. It’s handing out Wells notices like Halloween candy or gifts on Oprah’s show back in the day.

What they’re really looking to allege remains a bit clouded, as the recipients of the Wells notices are given some info (and then can potentially confer with the SEC via phone chat) but none of this is made public.

However, it’s fair to say that nothing’s changed, even if the case numbers are lower on paper. The SEC is still looking to utilize the US court system to regulate an industry, and it doesn’t seem to have any intention of offering public clarity into its thought process.

As the wise Taylor Swift once said: Haters gonna hate, hate, hate.

— Katherine Ross

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.