Binance Bitcoin Flow Stable Amidst Regulatory Challenges, Possible Executive Shakeup

On chain data sources show there’s plenty of bitcoin flowing through Binance’s wallet, but there’s yet a capital flight.

key takeaways

- Binance has had a tough month of regulatory challenges which culminated in its CEO offering to resign

- Despite this, the market still has confidence in the exchange as outflows aren’t trending above the market norm

Binance’s CEO Changpeng “CZ” Zhao said yesterday that he would be willing to step down as the exchange pivots to become a regulated entity amidst continued inquiries from regulators worldwide.

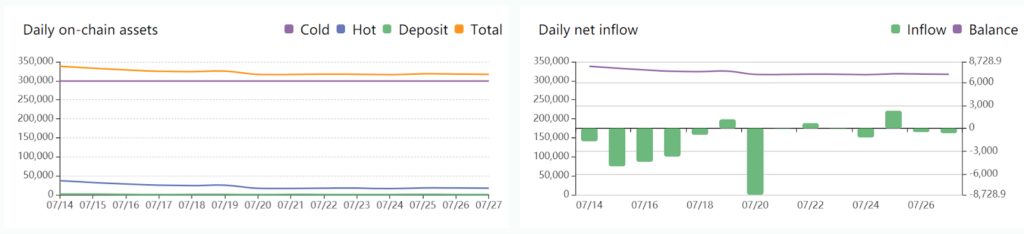

Despite initial reports of an uptick in outflow from the exchange, data from on-chain aggregator Chain.info shows that flow is stable and the market hasn’t voted with its virtual feet to vacate the exchange.

According to data from Chain.info, the majority of volume from Binance has been moves within internal wallets. This is likely due to reconfiguring of portfolios to prepare for next week’s hard fork of Ethereum, and the subsequent price movements on ether and the broader DeFi market.

Chainalysis reports that within the overall market, bitcoin inflows to exchanges are above the 180 day average at 88,600 BTC. With bitcoin’s recent rally to nearly $40,000, Chainalysis says that the last week has seen a higher-than-average flow of bitcoin to fiat exchanges as traders are looking to cash out. This is still down on-year given the last few months’ bear market following May’s crypto crash.

Separately, Whale Alert, a service that monitors the movement of large crypto transactions, noted that a trader moved over $1.3 billion in bitcoin off of Coinbase in three separate transactions. But despite that might look like an intense period for trading, Chainalysis says that the median trade intensity is below the 180 day average — however, it jumped significantly between July 25-26.

The price of BNB, Binance’s exchange token that’s often seen to be the equivalent of an equity, is up 2% to $314 according to data from CoinGecko.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.