Bitcoin Price Drop Tests Miners’ Diamond Hands

How long can bitcoin mining companies hold on to their coinbase rewards before being forced to sell?

Crypto mining farm; Soure: Shutterstock

Bitcoin miners are facing a tough few weeks ahead as meager prices threaten to render the network service unfeasible for anyone but the largest operators.

After shedding a quarter of its value throughout the FTX saga, the price of bitcoin is hovering around $16,300, down 66% year to date. Electricity prices —- which directly impact bitcoin mining profitability — in the US have jumped by about 13% in that time.

Bitcoin fading as electricity rates spike is obviously bad for miners: It can turn bitcoin mining into a loser’s game. One calculator offered by Braiins shows the cost of producing 1 BTC with a top-of-the-line Bitmain Antminer S19j is currently $34,732 — more than double bitcoin’s price.

And that’s based on electricity prices at $0.06 per kilowatt hour; the US Bureau of Labor Statistics reported a national average at $0.166 last month. Data visualization portal MacroMicro shows a lower global average cost, around $22,300, still 37% above bitcoin’s current price.

Although, some large scale mining operations are vertically integrated. Firms like Greenidge control their own power sources, which makes the whole process significantly cheaper.

Still, margins are thin across the board; one indicator built by investment unit Capriole measures the ratio of bitcoin sold from miner reserves to their overall balance — it has jumped 500% in the past month, now at its highest reading in years.

“Higher equals more selling. We also sum the miner output over 30 days and compare it to average miner reserves held over the last 30 days, we think it highlights high miner selling very well,” Charles Edwards, founder at Capriole, told Blockworks.

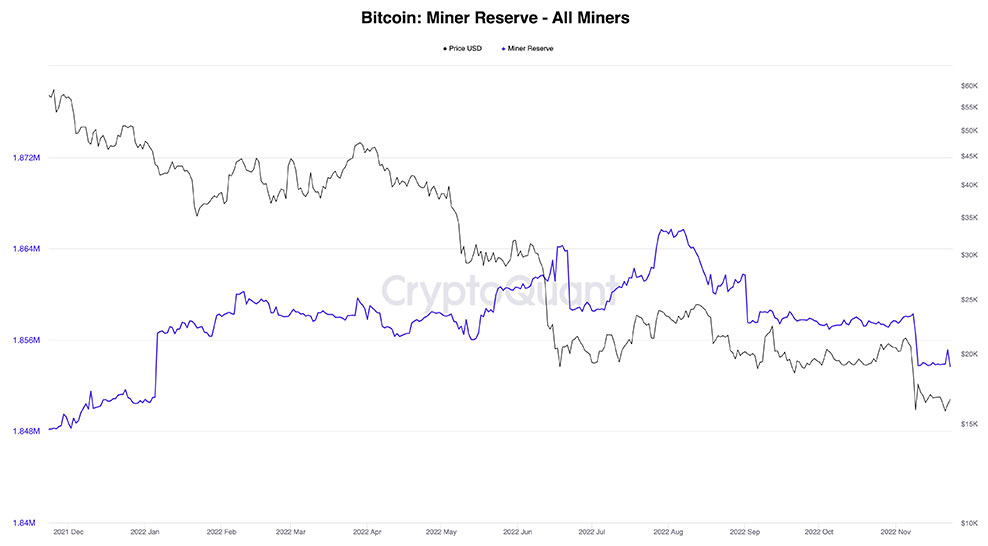

Bitcoin miners have indeed been selling regularly, but the total sum of their treasuries has more-or-less held steady this year. In fact, miners together hold 8,184 more bitcoins than at the start of 2022, per CryptoQuant.

Capriole’s indicator may be picking up a round of dumps, just as crypto reckoned with the impending collapse of FTX and its ensuing contagion. Bitcoin miners collectively sold 4,502 BTC between Nov. 7 and Nov. 8, according to CryptoQuant, a haul potentially worth up to $93 million.

Bitcoin’s price collapsed 24% around the same, dropping from $20,600 to under $15,800. Measuring miners’ direct impact on that move is difficult, but it’s clear that capital preservation is front-of-mind.

Bitcoin miners still hold more than 1.85 million BTC worth about $30.5 billion, representing almost 10% of the supply.

Loans backed by bitcoin miners to buy more bitcoin miners

Another spanner: A raft of major operators took out high-interest loans — in many cases backed by mining rig inventories — at the peak of the bull market last year. Sky-high prices made it en vogue to acquire as many mining rigs as possible, as quickly as possible.

Those inventories have since been delivered and are now mining away in hopes of actually paying for them — giving us the unusual mix of record high hashrate and crumpled prices.

Indeed, Bitcoin’s current thunderous hashrate is fueled by a fiscal need to generate revenue as soon as possible to pay back decisions made more than one year ago. This has driven mining difficulty (which impacts the odds of successfully mining bitcoin) through the roof while vaporizing operational margins.

Bitcoin miners have faced the grim reality of paying back those loans in a bear market for months now. Core Scientific, one of the largest miners in the industry by hashrate, warned the SEC last month that it would not be able to meet its loan obligations and could go bankrupt.

Core Scientific is now selling more bitcoin than it creates to stay afloat, having cashed in most of its bitcoin stash over the past few months. The firm has reported $435 million lost in the year’s third quarter, bringing its year-to-date damage to $1.7 billion and share prices losses to 98%.

Iris Energy, a smaller but sizable operation, disclosed default on loans worth $108 million this week. The firm has switched off mining rigs it used as collateral for expansion loans, similarly on the brink of bankruptcy.

Even diamond-handed Marathon warned shareholders earlier this year that it might start selling its mighty bitcoin stash, having historically projected intentions to hold indefinitely. The firm has mostly financed itself on stock sales and other debt raises, including a $500 million bond sale last November, as bitcoin was retreating from all-time high.

Todd Esse, co-founder at mining investment firm HashWorks Digital Industries, expressed to Blockworks that the next 30 days will prove critical for bitcoin miners just holding on.

“I think we’re getting to a point where we’re going to start seeing a lot of rings dropping off over the next 30 days, if we stay down at this level or go even lower,” Esse said, adding that he sees room for only two large mining outfits to retain the bulk of their bitcoin.

Falling energy prices could offer bitcoin miners a glimmer of profitability, albeit distant. “The market is being very selective about who can fit in right now, and it’s very tight.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.