Bitcoin, QQQ Correlation Dips to Lowest Level in More Than 3 Years

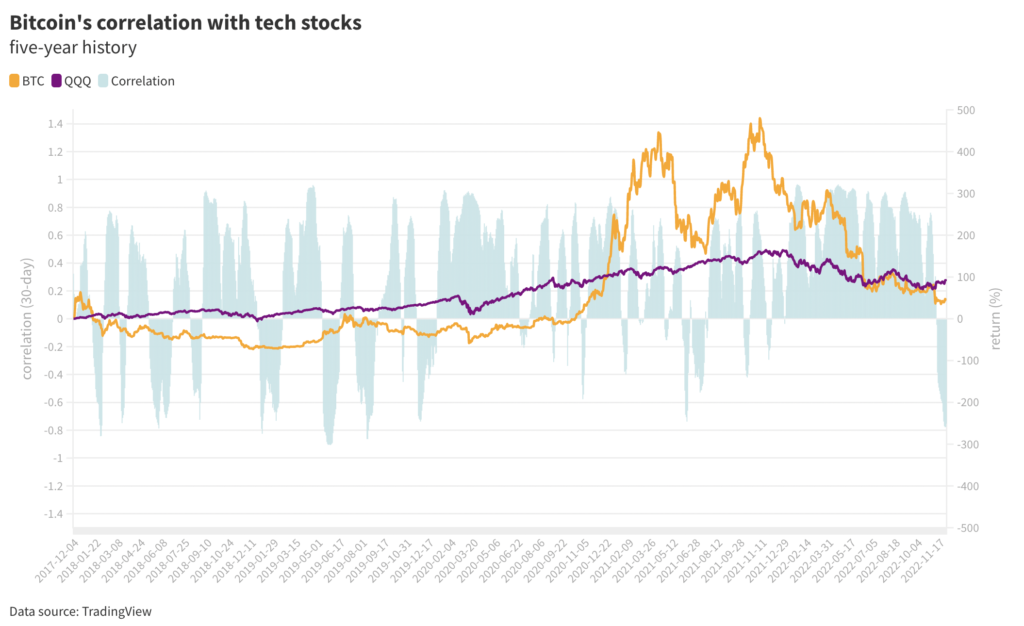

The 30-day correlation coefficient for bitcoin and QQQ, the tech-heavy ETF known as the Qs, sat at -0.75 on Friday.

Sodel Vladyslav/Shutterstock.com

Bitcoin has decoupled from Investo’s QQQ Trust, suggesting the cryptocurrency’s days of trading virtually in tandem with Big Tech stocks may be in the past — at least for now.

Bitcoin’s 30-day correlation coefficient to QQQ, the tech-heavy ETF known as the Qs, dipped below -0.77 to more three-year lows set on Thursday, per TradingView data. A correlation coefficient of -1 would mean the assets are moving in complete opposite directions.

BTC’s 60-day coefficient is also negative but not as extreme, sitting at -0.2, its lowest point since last July. Blue-chip, growth technology stocks are expected to continue underperforming, according to Tom Essaye, founder of Sevens Report Research.

“Tech and growth stocks have recovered some ground on value recently, but we continue to believe that progress in the economic recovery and subsequently higher interest rates will be a headwind for tech, and a rotation from growth to value can be utilized to reduce tech overweights, but not abandon super-cap tech holdings altogether,” Essaye said.

The divergence comes as equities have dipped, following a stronger-than-anticipated jobs report, which showed nonfarm payrolls increasing by 263,000 in November. Analysts expected a 200,000 raise. Average hourly earnings also increased 0.6% between November and October and are up more than 5% year over year, suggesting the Fed’s efforts to curb inflation may not yet be sufficient.

The S&P 500 and Nasdaq Composite indexes were each trading about 0.5% lower halfway through Friday’s session. Bitcoin was largely flat, while ether rallied 0.4%. QQQ lost close to 1%.

Still, risk-off sentiment is likely to persist in the long run, analysts say.

“Crypto traders need to remember that a key reason why crypto has fallen so much over the past year is that inflation was out of control and central banks were motivated to send rates higher which ultimately was bad news for all risky assets,” Edward Moya, senior market analyst at Oanda, said in a note Friday.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.