Bitcoin Reclaims $55,000 on Strong Fundamentals: Markets Wrap

Bitcoin dominance rises as price surges to $55,000, CME open interest and basis are on the rise indicating institutional demand.

Blockworks Exclusive Art by Axel Rangel

key takeaways

- Bitcoin supply is becoming illiquid while CME futures activity picks up

- Bitcoin dominance continues its rally

Expert Insight

“We know at Genesis that the institutions are increasing their interest because we talk to them, but you know institutions take time to get all the due diligence. So, we know that the interest has been building. We also know that the liquid supply of Bitcoin has been declining because this is something you can see by simply looking at the on-chain data.

The buyers so far this year have mostly been long-term holders, which means that as more and more Bitcoin gets bought and tucked away in cold storage for investment purposes, there is less liquid supply for new buyers to purchase. So you have a growing institutional interest against the backdrop of declining liquid supply.”

-Noelle Acheson, Head of Market Insights at Genesis

Bitcoin

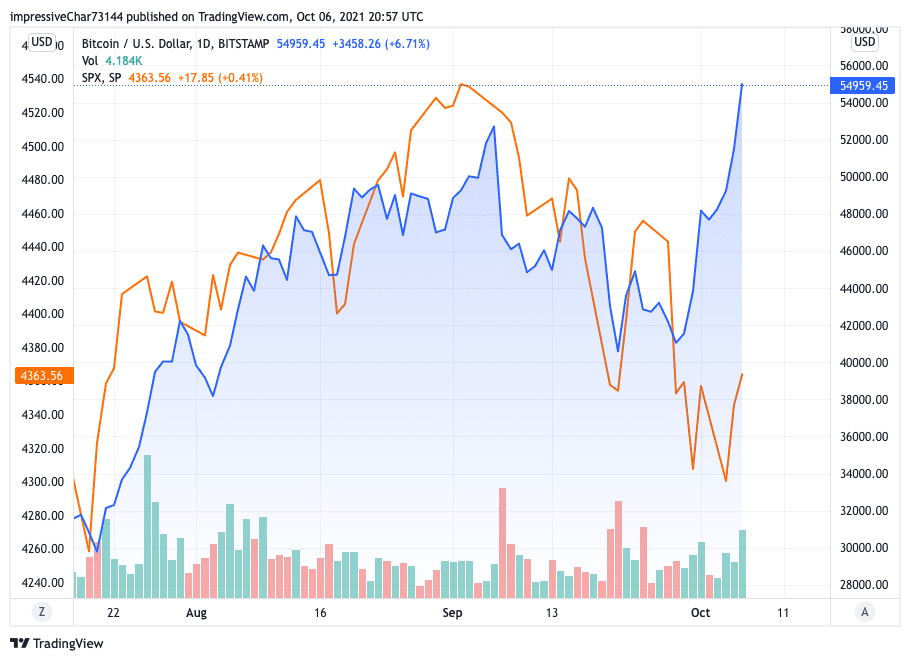

Historically speaking, the Bitcoin price and S&P 500 have had a tight correlation. Since the beginning of October, that correlation has begun to weaken. Whether the trend will continue remains to be seen.

BTC futures open interest on CME, a futures exchange where a lot of institutional activity takes place, has risen 33% from September 7th to October 5th.

“The other thing that screams that this is institutionally driven for me is the CME basis. The CME derivatives exchange offers the lowest leverage of any crypto derivatives exchange,” Noelle Acheson of Genesis told Blockworks. “And yet the basis, which is the difference between the futures price on the CME and the spot price, started shooting up this morning. It’s now even higher than the basis on some of the other higher leverage futures exchanges.”

Ethereum

With some of the other major Layer-1’s such as Solana ($SOL), Terra ($LUNA), and Binance Smart Chain ($BSC) underperforming and $ETH holding its ground, it appears that the rotation into the blue-chips of the digital asset industry is underway.

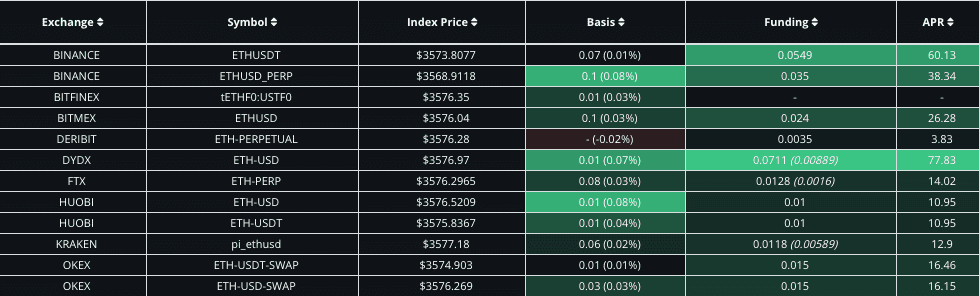

The put:call ratio for Ethereum sits at 0.647, according to laevitas.ch, signaling that traders are heavily favoring calls over puts. Perpetual funding rates are fairly high on some of the exchanges with the largest volume, indicating that traders taking a long position are paying hefty premiums to hold their position. It is currently at a 60.13% APR on the Binance ETH/USDT pair.

Non-Fungible Tokens (NFTs)

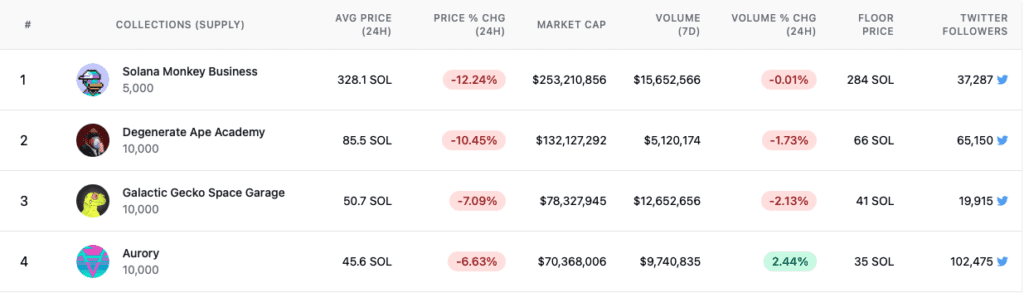

NFTs continue their hot streak, notching $10 billion in sales for 2021 as of today according to a report from CNBC. Bank of America also released an extensive report on digital assets and had some interesting words on NFTs; “NFTs can be used instead of deeds, titles or anything currently needed to demonstrate ownership — and all without a middleman charging a fee”. Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects.

DeFi

- Fei protocol, a project that aims to create a decentralized stable coin, made a large upgrade to the Fei mechanism.

- Lido Finance, a non-custodial staking solution, responds to some vulnerabilities that were reported yesterday.

- Olympus DAO unveils a new service that aims to share Olympus’ bond innovation with treasuries across DeFi, per messari analyst, Chase Devens.

Total Value Locked (TVL) in DeFi is hovering around all-time-highs.

What else we are looking out for…

- Initial and continuing jobless claims on Thursday

- Nonfarm payrolls, unemployment rate and average hourly earnings on Friday

That is all for today, folks. Let’s do this again at the same time tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.