BTC, ETH and LUNA Lead Rebound After Friday Omicron Sell-off: Markets Wrap

BTC, ETH and LUNA lead the rebound in digital assets after a large post Thanksgiving day sell-off induced by fears of a new Covid-19 variant.

key takeaways

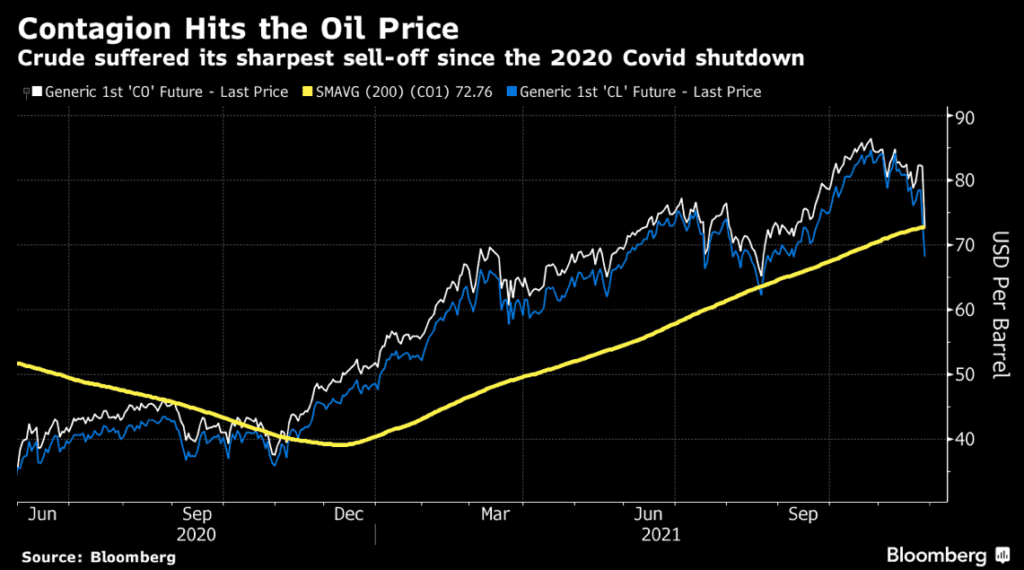

- A sustained correction in oil prices would help lower headline CPI prints

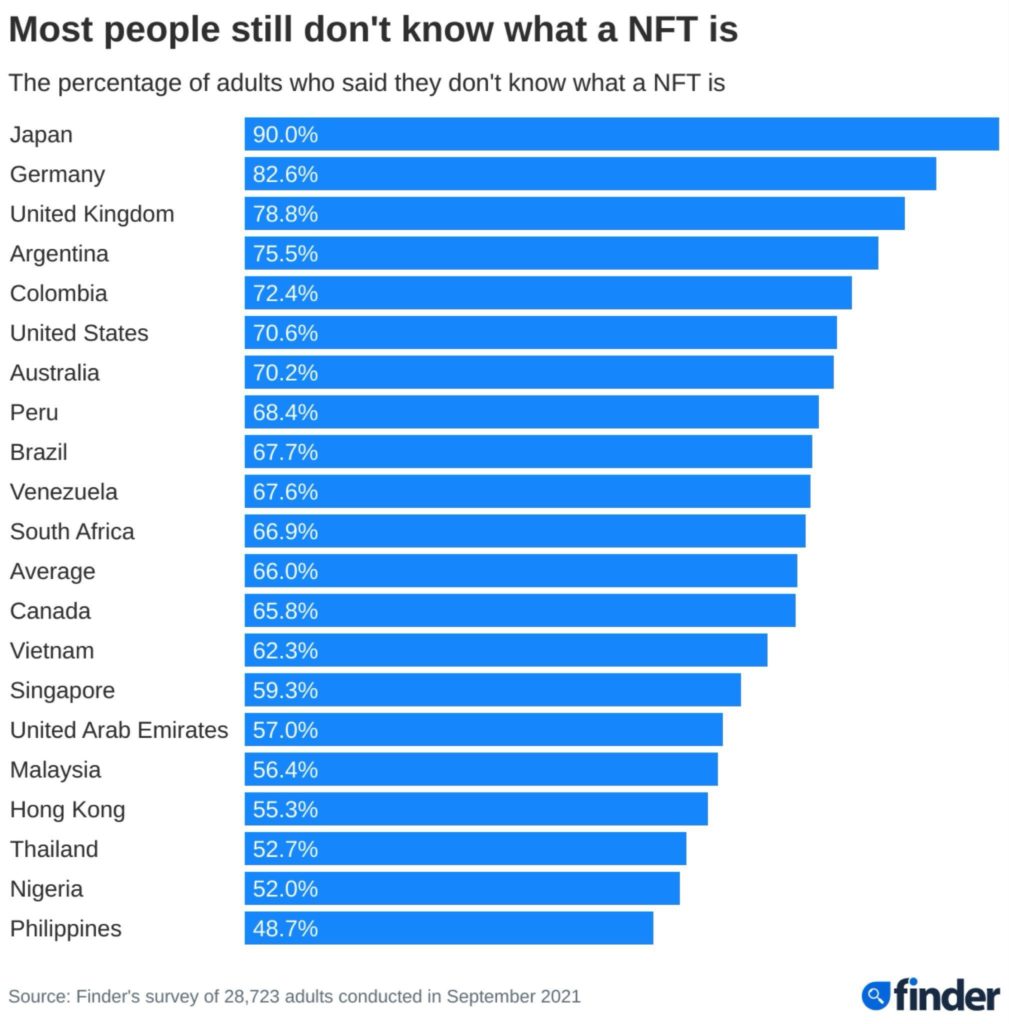

- Japan is the largest laggard when it comes to knowledge on NFTs, according to data compiled by Finder

Digital assets sold off alongside traditional financial markets last Friday due to an emerging Covid-19 variant; Omicron.

A sustained correction in oil prices would help lower headline CPI prints.

The Fed would be put in a tough situation if the variant hindered its ability to tighten monetary policy in the face of high inflation.

BTC, ETH and LUNA led the way as digital assets rallied from their Friday lows.

Japan is the largest laggard when it comes to knowledge on NFTs, according to data compiled by Finder.

Latest in Macro:

- S&P 500: 4,655, +1.32%

- NASDAQ: 15,782, +1.88%

- Gold: $1,784, -.44%

- WTI Crude Oil: $69.58, +2.10%

- 10-Year Treasury: 1.516%, +.031%

Latest in Crypto:

- BTC: $58,107, +5.61%

- ETH: $4,421, +6.29%

- ETH/BTC: 0.0760, +1.46%

- BTC.D: 42.61%, -0.55%

Omicron overview

Both traditional financial markets and digital asset markets sold off in a big way last Friday on news that a more infectious variant of Covid-19, called Omicron, had begun to take hold in South Africa and some parts of Europe. While the preliminary data is from a small sample set, some experts have said that the variant appears to be less lethal.

The South African doctor who first identified the Omicron variant, Dr. Angelique Coetzee, told BBC, “What we are seeing clinically in South Africa, and remember that I’m at the epicenter, that’s where I’m practicing, is extremely mild…We haven’t admitted anyone [to hospital]. I spoke to other colleagues of mine: the same picture.”

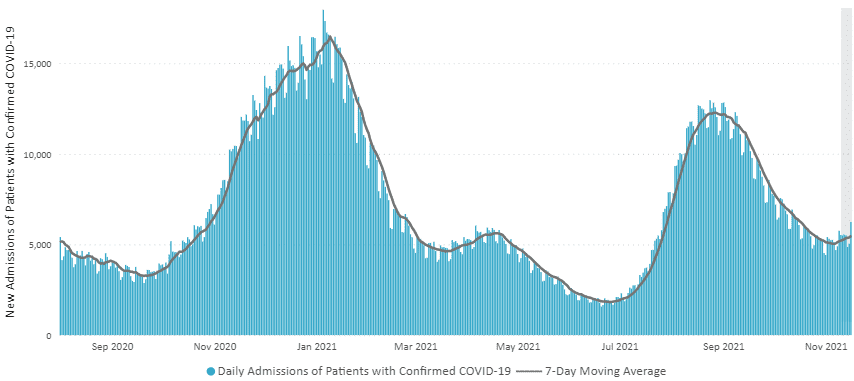

While the daily number of cases worldwide has been rising over the past month, hospitalizations have remained relatively flat according to data taken from the CDC’s website.

Reports of the Omicron variant come as the Fed looks to taper asset purchases and the market is pricing in multiple rate hikes in 2022. The US is facing the highest level of inflation in the past 30 years, and another wave of the virus could threaten the Fed’s ability to tighten its monetary policy and thus exacerbate inflation risks.

Oil took a huge hit on Friday, trading down from highs of $74 to around $68, its lowest level since September. While the emerging variant comes as bad news for everyone, lower oil prices will please consumers at the pumps and potentially aid President Biden’s approval ratings. The WTI crude oil front-month has rebounded strongly today, last trading near $70 per barrel.

Friday marked the largest risk-off move since June of 2020, as shown by the SPY/TLT ETF ratio. Investors rotated from risk-on assets such as equities and digital assets into risk-off assets such as long-dated treasuries.

Prominent investor, Bill Ackman, took to Twitter to share his view: “A thought. While it is too early to have definitive data, early reported data suggest that the Omicron virus causes ‘mild to moderate’ symptoms (less severity) and is more transmissible. If this turns out to be true, this is bullish not bearish for markets.”

BTC

MicroStrategy CEO Michael Saylor championed his company’s latest big bitcoin buy on Twitter Monday morning — a whopping 7,002 BTC totaling $414.4 million in cash with an average entry price of $59,187 per bitcoin, Blockworks reported earlier today. The company now holds 121,044 BTC, or roughly .64% of the circulating supply.

Last Monday, El Salvador announced it would issue a $1 billion tokenized bond via Blockstream’s Liquid sidechain with $500 million allocated to the construction of the city and $500 million used to buy more bitcoin.

BTC has rallied from its lows last Friday of roughly $53,600 to just shy of $59,000 today. With perpetual funding rates sitting at much lower levels when compared to the rally to all-time highs seen earlier in November, this move could look rather healthy. It is also worth noting that the Crypto Fear and Greed Index is still sitting at 33, which indicates that market participants are still skeptical of BTC’s rally.

ETH

ETH has rebounded since its lows of roughly $3,933 seen on Friday to over $4,400 today. ETH is up over 10% in the last 24-hour period. The strong price action coincides with news that Kelly ETFs has filed for an Ethereum futures ETF, according to Eric Balchunas.

Ethereum has seen the number of active addresses on the network continue to climb. The net issuance of ETH continues to fall towards zero, unique addresses are increasing, scaling solutions are increasing and mainstream use cases continue to unfold, such as Sotheby’s denominating prices in ETH.

Ethereum critics point to the high transaction fees as the Achilles’ heel of the leading smart contract enabled platform. However, scaling solutions are progressing rapidly and are expected to gain adoption over the coming year.

StarkWare launched StarkNet Alpha, an Ethereum layer-2 scaling solution that utilizes ZK-rollups, according to a company released statement.

“StarkWare is building StarkNet, a decentralized permissionless STARK-powered L2 ZK-Rollup over Ethereum, that supports general-computation based on the Cairo language.” reads a StarkWare released medium article. “StarkNet will enable applications to scale without compromising security, users to pay reasonable transaction fees, and the entire ecosystem to grow substantially and fulfill its promise.”

dYdX and ImmutableX are two protocols that utilize StarkWare scaling solutions, and are among the largest layer-2 projects by TVL. The top 10 layer-2 scaling solutions on Ethereum can be seen in the following table:

LUNA

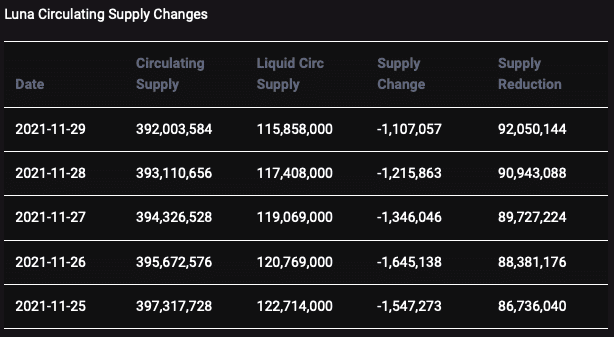

LUNA is approaching its all-time high of $54.16, last trading just shy of $53. It is up over 29% over the past seven days and is the top large cap performer since Friday’s sell-off.

The move comes on the heels of five straight days of more than 1 million LUNA being burned, according to data taken from terra.smartstake.io. This has reduced the circulating LUNA supply from 122.7 million to 115.8 million, or a decline of 5.6%.

The market capitalization of its largest stablecoin, UST, has grown from $2.88 billion to $7.53 billion since November 9, thanks to the community pool burn and collaboration with Abracadabra.Money. The launch of Astroport and Mars in the coming weeks is expected to increase demand for UST.

Non-Fungible Tokens (NFTs)

Data taken by Finder shows that Japan and Germany are the two biggest laggards on the adoption curve when it comes to NFTs.

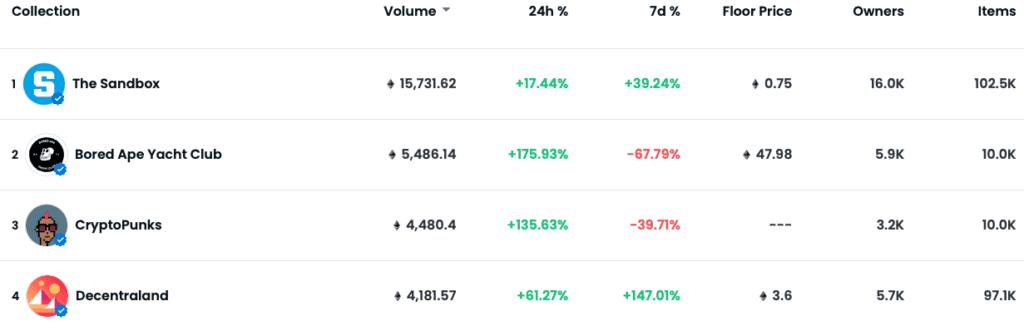

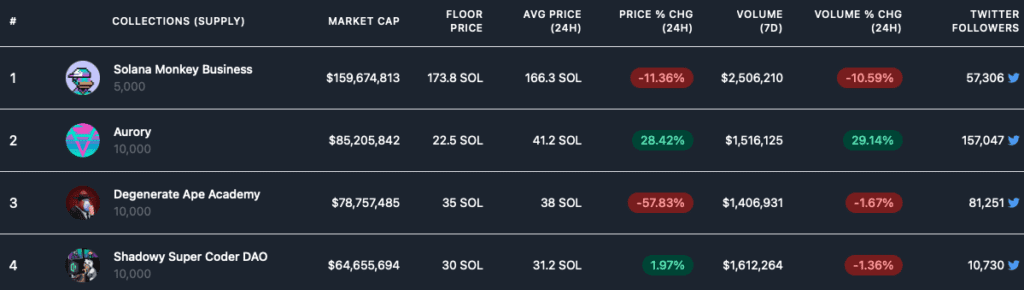

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.