BTC Retreats as Digital Assets Sell Off: Markets Wrap

Bitcoin breaks below $48,000 as daily exchange volumes and network activity remain stagnant

A piece by WARHODL whose work was on display at the Bitcoin 2021 Art Gallery

key takeaways

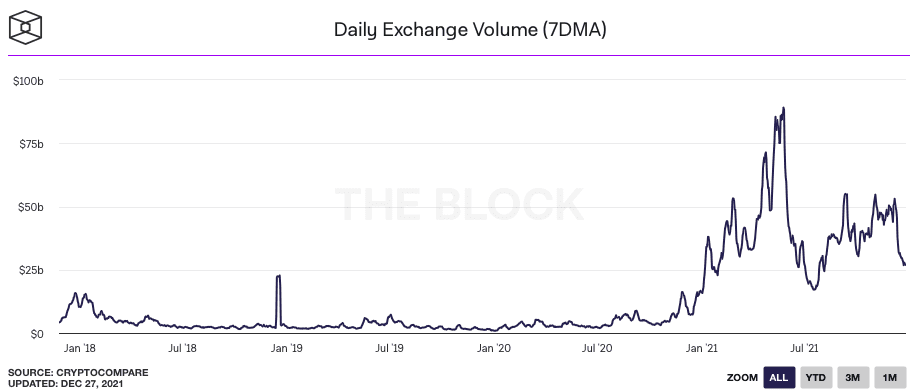

- Daily exchange volumes are down from the highs seen in May of 2021

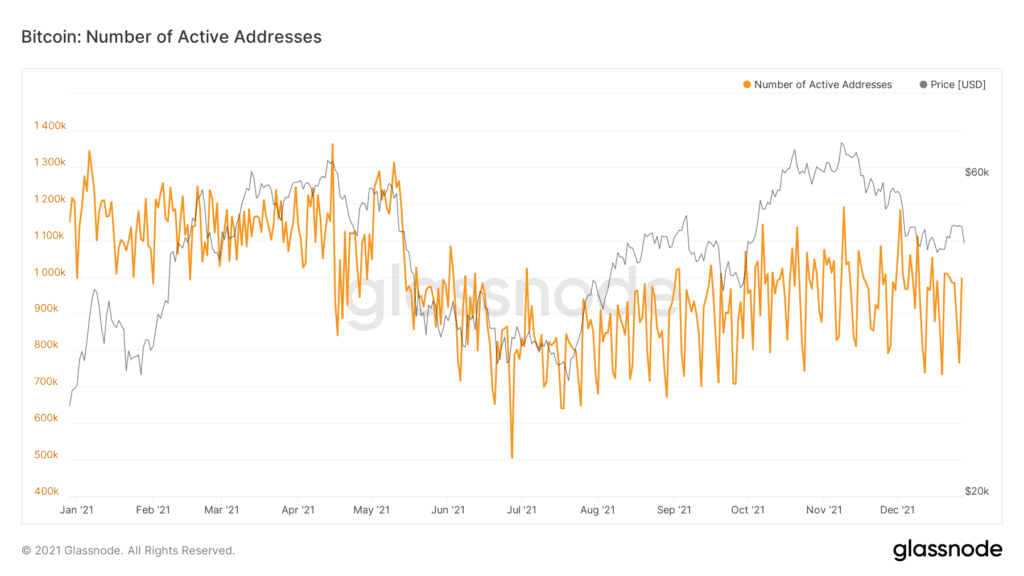

- Activity on the Bitcoin network has been flat to down throughout 2021

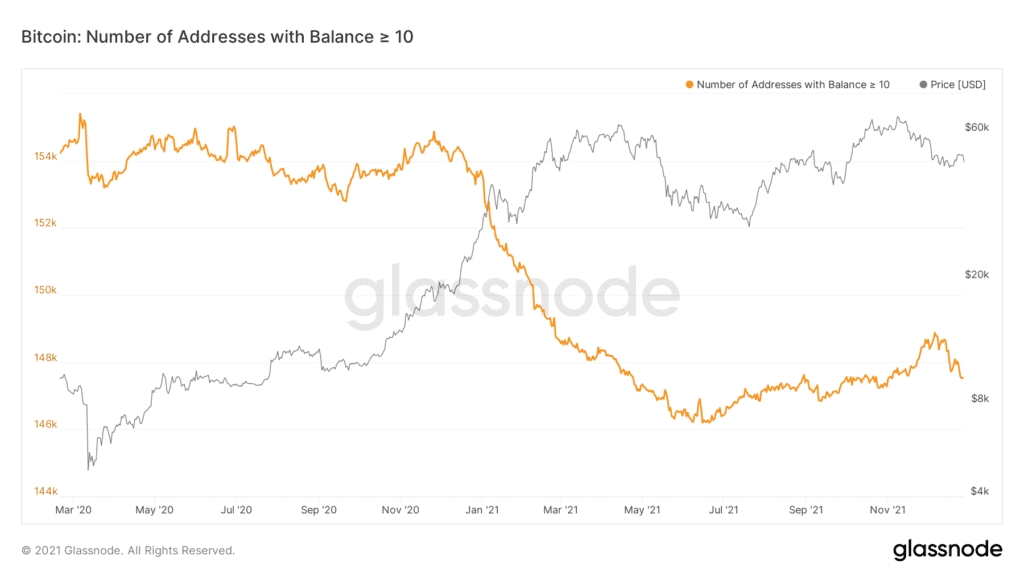

The number of BTC wallet addresses holding 10 or more BTC has been in a downtrend since the end of 2020.

Daily exchange volume has yet to return to levels seen earlier in 2021 as they hover in the $25 billion to $50 billion range.

Active addresses on the Bitcoin network are down from 1.2 million at the beginning of 2021 to 995,000 today.

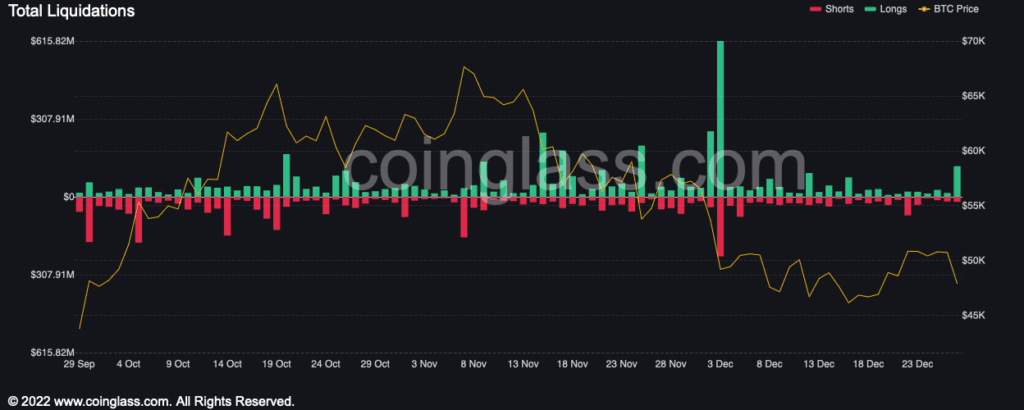

$120.87 million of long positions have been liquidated over the last 24 hours as a result of today’s BTC price action.

Latest in Macro:

- S&P 500: 4,786, -0.10%

- NASDAQ: 15,781, -0.56%

- Gold: $1,805, -0.36%

- WTI Crude Oil: $75.99, +0.56%

- 10-Year Treasury: 1.482%, +0.001%

Latest in Crypto:

- BTC: $47,844, -6.70%

- ETH: $3,831, -6.40%

- ETH/BTC: 0.0800, +0.73%

- BTC.D: 39.95%, -0.27%

Declining exchange volume

Daily exchange volume has yet to return to levels seen earlier in 2021 as they hover in the $25 billion to $50 billion range, according to data from The Block.

Stagnant activity on the Bitcoin network

Active addresses on the Bitcoin network are down from 1.2 million at the beginning of 2021 to 995,000 today, according to data from Glassnode.

While institutional interest was a common narrative over 2021, the number of BTC wallet addresses holding 10 or more BTC has been in a downtrend since the end of 2020, according to data from Glassnode, as smart money took profits into price strength.

“…We are still digesting a large loss of active wallets from China and non-China growth, therefore, [the addition of new wallets needs to be greater than the loss of active wallets from China] to exceed that loss of accounts for the network to re-grow too. Likely a matter of time,” wrote Raoul Pal, founder of Global Macro Investor. “Additionally, I didn’t mention that institutional rebalancing, tax-related selling and hedgies squaring books has also added to year-end weakness. This is more temporary, most likely”.

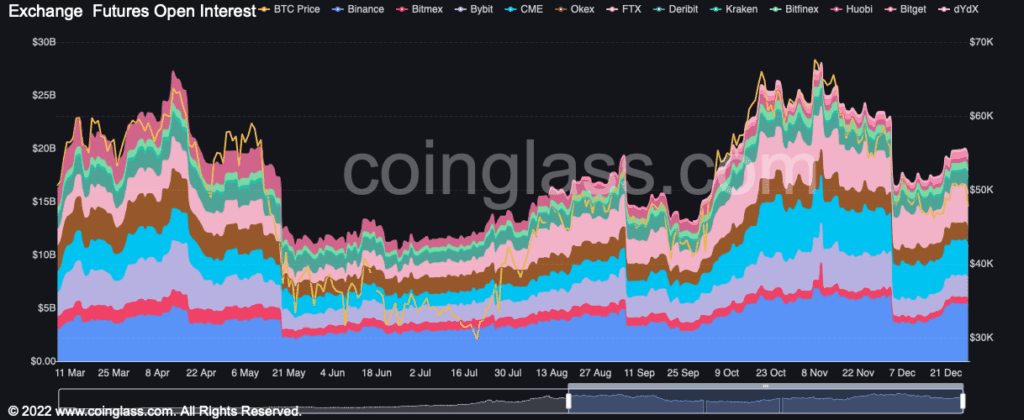

Liquidations

$120.87 million of long positions have been liquidated over the last 24 hours as a result of today’s BTC price action, according to data from Coinglass.

BTC futures open interest sits at $19.22 billion, according to Coinglass, so there are plenty of long side positions that are yet to be liquidated.

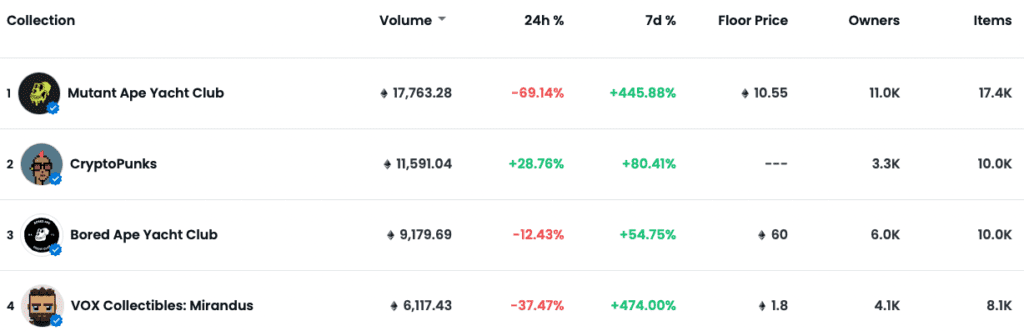

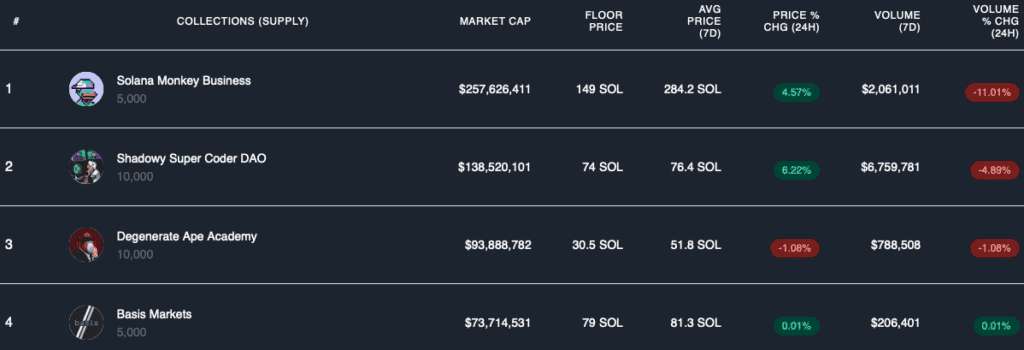

NFTs

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.