Could Bitcoin’s Price Action Be Signaling Macro Danger?: Markets Wrap

The Fed looks to tighten monetary policy in the face of high inflation, BTC price action may be foreshadowing a Fed policy error.

Blockworks exclusive art by Axel Rangel

key takeaways

- The Fed looks to tighten monetary policy as it de-levers Federal debt load.

- BTC price action may be signaling premature tightening by the Fed.

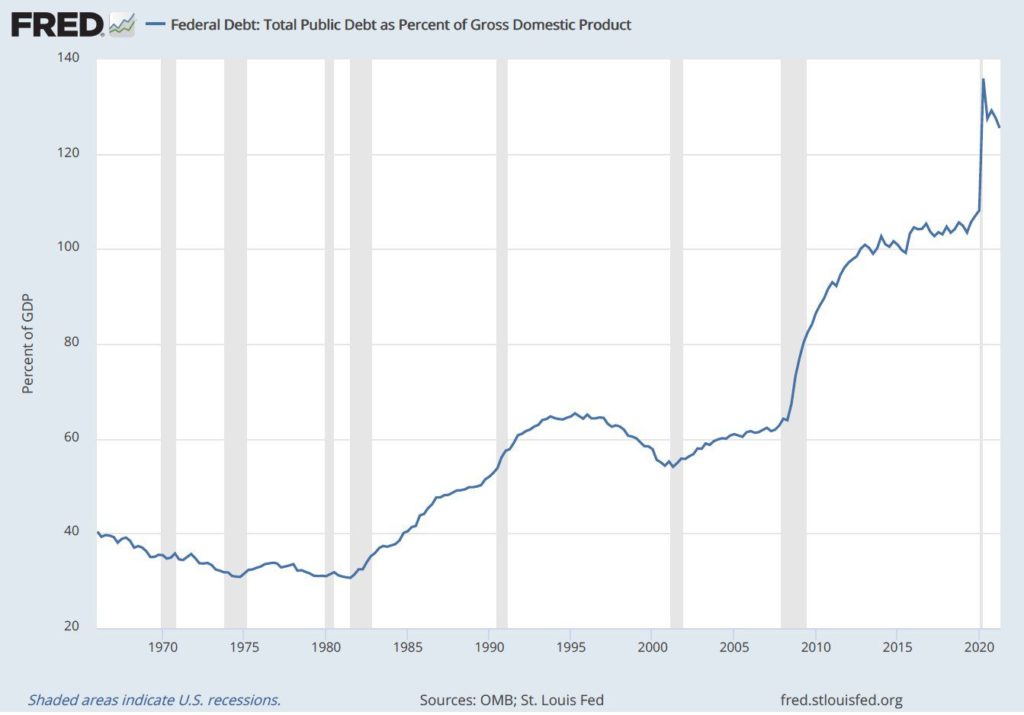

The Fed looks to de-lever the Federal debt load, but despite their efforts the debt-to-GDP ratio remains elevated.

High inflation and the omicron variant puts the Fed in a tough position as it relates to monetary policy.

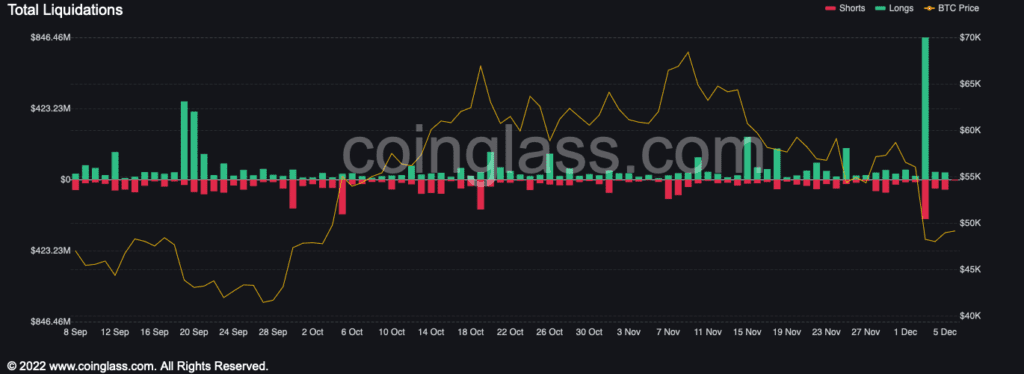

BTC sold-off over the weekend, spurring a widespread liquidation event.

BTC funding rates and futures open interest have declined, implying less leverage in the market.

Adoption of Bitcoin continues to take hold despite short-term price volatility.

ETH/BTC broke out of a multi-month range, signaling strength for the world’s largest smart contract enabled computing platform.

Latest in Macro:

- S&P 500: 4,591, +1.18%

- NASDAQ: 15,222, +0.93%

- Gold: $1,780, -0.19%

- WTI Crude Oil: $69.67, +5.16%

- 10-Year Treasury: 1.426%, +0.085%

Latest in Crypto:

- BTC: $48,928, -0.15%

- ETH: $4,204, +1.24%

- ETH/BTC: 0.0860, +1.26%

- BTC.D: 41.02%, -0.33%

Tightening monetary policy

The Fed announced in early November that it would begin tapering asset purchases in the face of high inflation prints.

“Tapering of monthly bond purchases at a reduction of $15 billion a month will begin shortly, the Federal Open Market Committee said in its post-meeting statement,” according to a previous Blockworks report. “The central bank is currently purchasing $120 billion in assets a month. The tapering will be broken down as a $10 billion reduction in Treasuries and a $5 billion reduction in mortgage-backed securities.”

The emerging Omicron variant of the Covid-19 virus has also contributed to the added volatility seen in markets over the past few weeks.

The taper is expected to be followed by gradual rate hikes throughout 2022. However, the market is torn on when the rate hikes will occur due to the aforementioned issue of inflation.

Lyn Alden, Founder of Lyn Alden Investment Strategy, wrote, “I do think the Fed is likely to reduce its rate of asset purchases, and we’ll see if they get some 0.25% rate hikes in. The question then becomes how long they will be able to tighten for, and how loose will they be compared to the prevailing inflation rate (e.g. even if you raise rates to 1%, that’s not very comforting when inflation is 6%).”

Despite the highest CPI print in over 30 years in the US and negative real-rates on treasuries, the debt-to-GDP ratio has only fallen from ~135% to ~125%. This tells investors that the federal debt load has only been de-levered to a minor degree thus far.

Bitcoin flash-crash

After the rangebound price action seen last week between $56,000 to $59,000, BTC finally made a decisive move to the downside.

“While funding rates are only showing a slightly positive bias when compared to the end of October run-up, the vast amount of derivatives-based open interest leaves the door open for a leverage washout of the shorts or the longs.” I wrote last week in a Blockworks markets wrap. “In short, liquidations could spur an explosive upwards or downwards move but only time will tell which way it unfolds.”

Unfortunately for BTC investors, the move spurred over $1 billion of long liquidations over the weekend, sending the price tumbling to as low as $42,333 according to data taken from Coinbase.

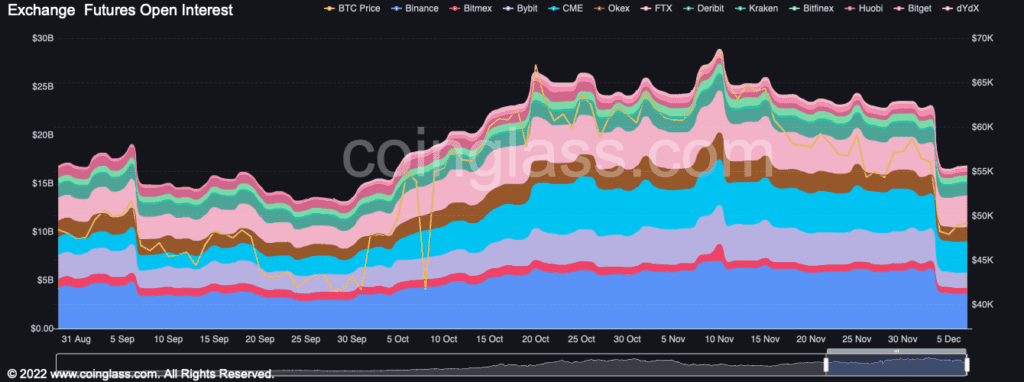

On the bright side, futures open interest took a dive as a result of the sell-off, which makes for a healthy cleanse of the market structure that could help position BTC for an early 2022 rally. Futures open interest dropped from $23.05 billion on Dec. 3 to $16.81 billion today, according to data from Coinglass.

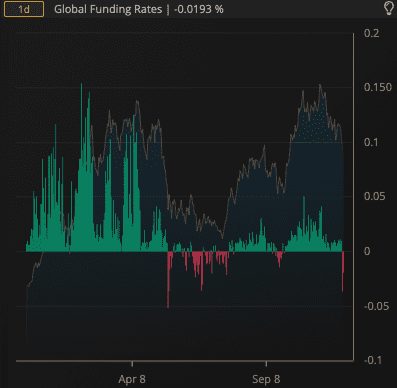

Perpetual funding rates have also lowered as a result of the sell-off, which reaffirms the idea that there is less leverage in the market today, according to data from laevitas.ch. Funding rates did not reach the exuberant levels seen earlier in 2021, but nonetheless are something to monitor for market sentiment going forward.

BTC may be foreshadowing a Fed policy error

The Fed told markets for months that the higher inflation prints were just ‘transitory,’ but back pedaled on its stance when Federal Reserve Chair Jerome Powell stated last week that it was time to retire the word ‘transitory’ as it relates to inflation.

“The inflation that we’re seeing is really not due to a tight labor market,” said Powell during a press conference in early November. “It’s due to bottlenecks, and it’s due to shortages and it’s due to very strong demand meeting those.”

Luke Gromen, Founder of Forest For The Trees (FFTT), took to Twitter after the flash-crash to explain how BTC may be foreshadowing a policy error by the Fed in tightening monetary policy too quickly.

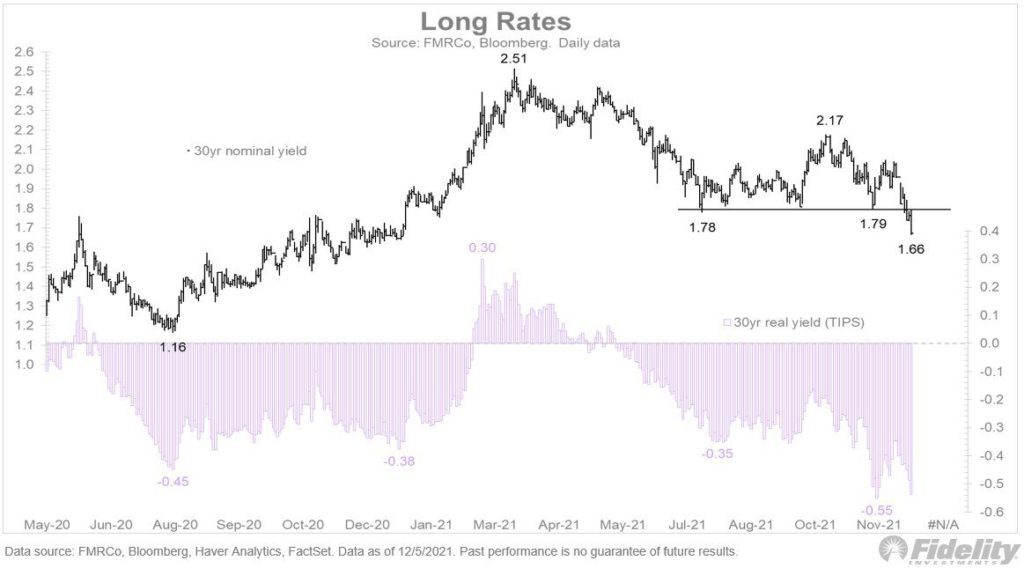

Jurrien Timmer, Director of Global Macro at Fidelity, voiced similar concerns in regards to a policy error by the Fed but in the context of the bond market.

“Is the bond market signaling that the Fed is about to commit a policy error by turbo-tapering and then tightening?” asked Timmer on Twitter. “This chart shows the long bond yield has broken down to a new low for the year. It will be interesting to see what happens at next week’s FOMC meeting”.

Macro uncertainty will likely lead to more volatility in the coming weeks and months ahead, but the adoption of cryptocurrencies remains robust.

“What might trip up the advancing three musketeers — Bitcoin, Ethereum and crypto dollars — may be the more profound question for 2022, but we expect wider adoption to prevail and overcome most wobbles, like 2021’s near 50% correction,” Senior Commodity Strategist at Bloomberg Intelligence, Mike McGlone, wrote. “Some normalization in stock-market returns and a continued decline in U.S. Treasury bond yields may shine on Bitcoin and Ethereum in portfolios.”

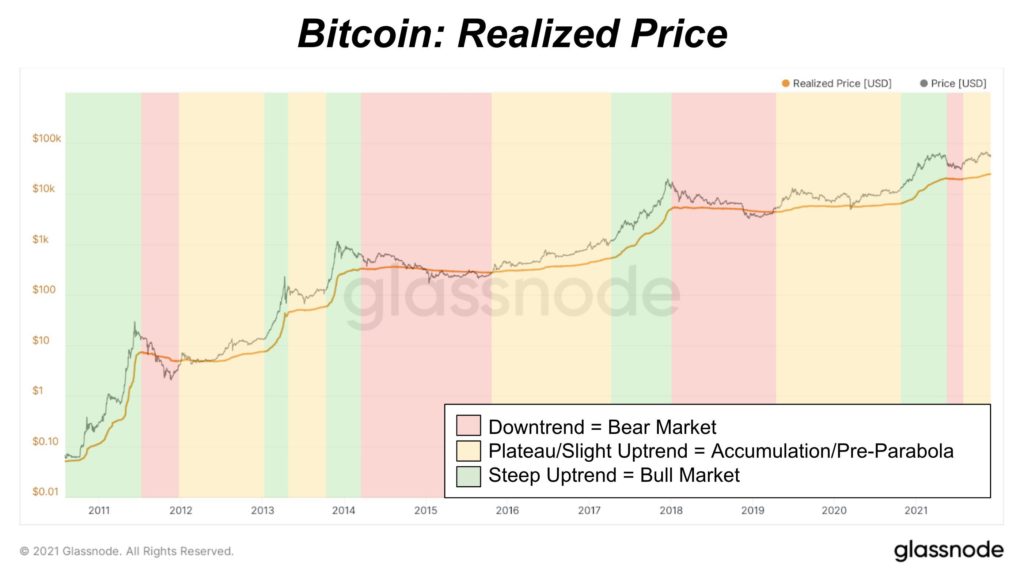

The BTC realized cost, or the average cost basis of BTC holders, continues to march upward according to data form Glassnode. This could be a healthy signal to follow because in theory this raises BTC’s floor price to some degree.

Based on this metric, it looks like we may be in an accumulation phase. The current state of things look most comparable to the 2013-14 BTC bull run.

Wallet addresses holding less than 1 BTC continue to march higher as well, now representing over 5% of the BTC supply.

ETH outperforming BTC

The ETH/BTC ratio has broken out of a multi-month range. ETH has been very strong versus BTC since this past weekend’s sell-off.

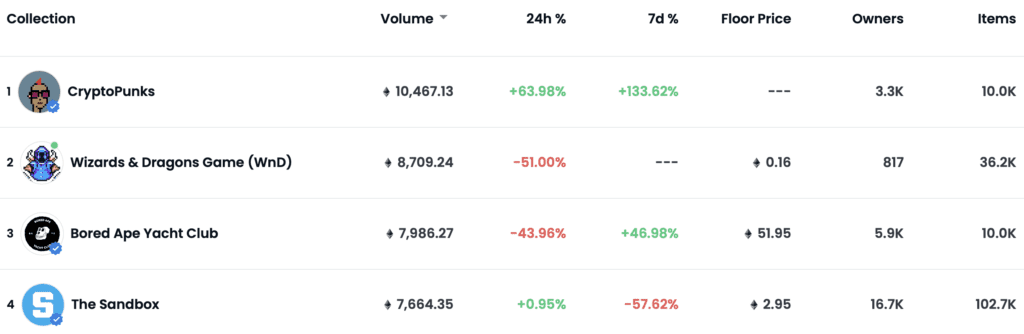

Non-Fungible Tokens (NFTs)

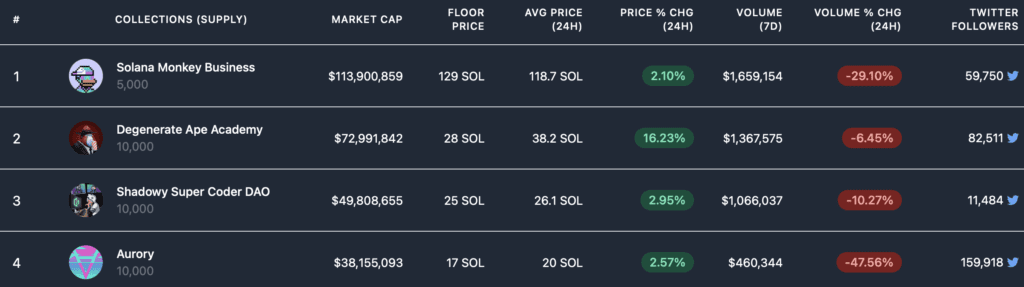

Solana-based NFTs are seeing a lot of downward sell pressure since this weekend’s liquidation cascade.

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up on tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.