Fireblocks launches payments network for stablecoins

The crypto infrastructure firm expands into payments with a stablecoin network connecting fintechs, banks, and issuers

Fireblocks CEO and co-founder Michael Shaulov | Permissionless I by Blockworks

Fireblocks, the $8 billion crypto infrastructure firm, has launched a new payments network designed for stablecoins.

Announced on Thursday, the Fireblocks Network for Payments brings together more than 40 participants, including Circle, stablecoin startup Bridge — recently acquired by Stripe — along with firms such as Zerohash and Yellow Card.

The initiative aims to reduce engineering costs and operational risks for companies building stablecoin products or transferring digital dollars across borders, according to CEO Michael Shaulov.

In July 2025, Fireblocks processed a record $212 billion in stablecoin volume, underscoring its role in the asset class. The firm already provides custody and transfer services for banks, including BNY Mellon and fintechs like Revolut, but its existing infrastructure was built around crypto trading rather than streamlined stablecoin payments.

Shaulov said the new network expands on models like the Circle Payments Network, but supports multiple stablecoins rather than only Circle’s USDC. The launch comes amid rising institutional interest: a Fireblocks report back in May found 90% of firms are already using or exploring stablecoin payment programs, with cross-border settlement cited as the top driver.

Blockworks Research data highlights the scale of stablecoin flows Fireblocks is targeting. On Ethereum, where $164 billion in stablecoins circulate, daily transfer volumes regularly exceed $60 billion. USDC alone accounts for nearly $47 billion in supply, while USDT still dominates at over $81 billion.

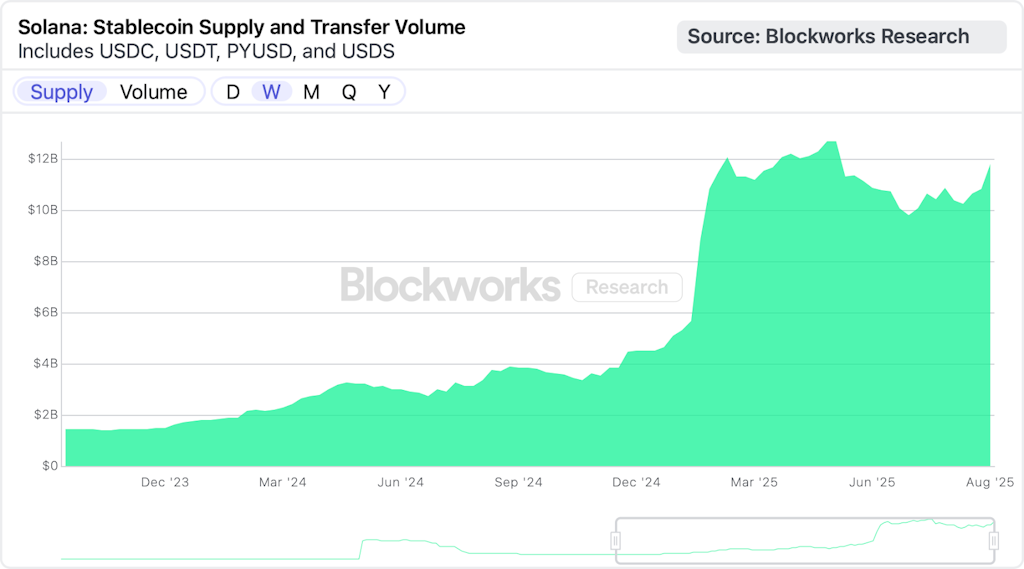

Solana stablecoin supply and transfers | Source: Blockworks Research

Meanwhile, Solana has emerged as a high-throughput stablecoin rail, processing around $11 billion in daily transfers across tokens like USDC, USDT and PYUSD.

The network handles roughly 3 billion monthly transactions (excluding validator votes), far outpacing Ethereum in raw activity. Stablecoin volume spikes have helped to drive Solana DEX trading to nearly $300 billion in monthly spot volume, cementing its role as a low-cost complement to Ethereum’s liquidity-heavy ecosystem.

This is a developing story.

This article was generated with the assistance of AI and reviewed by editor Jeffrey Albus before publication.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.