Lightspeed Newsletter: Solana’s rocky July 4th weekend

SOL’s price fell, but investors hope it has an ETF trick up its sleeve

Natchapol18/Shutterstock modified by Blockworks

Today, enjoy the Lightspeed newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Lightspeed newsletter.

Howdy!

I’m back in Brooklyn after some trafficky hours spent in the back middle seat of a Volvo to cap off a 4th of July road trip.

Sadly I’m not in Brussels for EthCC, but for readers who are across the pond, shoot us an email and let us know the vibes surrounding Solana over there. I’ll be interested to see what announcements come out of the conference. Anyways:

SOL rebounds after market bloodbath

Crypto markets re-enacted that blood-filled elevator scene from ‘The Shining’ over the holiday weekend as investors braced for potential bitcoin sales from the Mt. Gox estate. SOL glommed onto the bearish vibes, cratering to $122 on Friday, its lowest price since May 1, according to CoinGecko data.

The price has since recovered closer to $140, and some analysts say solana’s price could be buoyed by the card it’s holding that bitcoin and ether have already played — spot ETF approval.

When we last looked into SOL’s price prospects three weeks ago — as the asset had just fallen to $140 — Kaiko’s Adam Morgan McCarthy said uninspiring funding rates could indicate traders are rotating out of SOL and into bitcoin or ether.

So far in July, that rotation seems to have eased. Solana fell less in the past week than bitcoin and ether, and SOL bested ETH in inflows last week, $16 million to $10 million, according to CoinShares.

Marinade core contributor Michael Repetny said this is a familiar pattern — if bitcoin performs poorly, crypto traders will try to diversify into altcoins, with solana being the trendiest one currently.

Regardless, McCarthy told me today that he thinks a summer trading lull will cap SOL’s upside for the next couple of months.

New filings for solana spot ETFs could change that, since most of the spot bitcoin ETF issuers are yet to make a move on solana.

McCarthy pointed to the case made on the Bits + Bips podcast that VanEck and 21Shares’ SOL ETF filings are akin to call options on the US presidential race — that is, making a bet on a Trump victory and crypto-friendly regulatory environment.

“It will be interesting to see if other issuers are in a wait and see mode until after November or if they will file imminently — I suspect [it’s] the former,” McCarthy wrote in an email.

Brian D. Evans, founder of BDE Ventures, echoed the significance of ETF approval. Evans added that SOL’s fate could come down to its ability to maintain a narrative as memecoin hype dies down, and new competitors like Telegram-linked TON make their play for crypto mindshare.

— Jack Kubinec

Zero In

One stat I like to periodically check in on is Solana’s funding rate, or the premium paid between SOL buyers and sellers in futures markets.

A positive funding rate means long positions owe short positions a premium, whereas a negative funding rate means the short side of the futures market is crowded.

In this most recent market rout, Coinglass’ weighted measure of SOL’s funding rate hit its lowest mark in 2024, indicating that traders across a spate of exchanges aren’t thrilled with the prospect of long SOL positions.

— Jack Kubinec

The Pulse

Line go up… Line go down… Line has too much to drink at the BBQ and faceplants immediately while attempting to do a backflip…

Solana had a tough July 4th weekend, with prices hitting a low of around $122 amid a broader market crash. Investors were possibly spooked by the hotly anticipated Mt. Gox repayments, with many expecting a selloff to follow. Jerome Powell’s comments on future interest rate cuts and ongoing economic uncertainties probably didn’t help the market jitters either.

As candles went red, Crypto Twitter immediately flipped into bear mode. User @notsxlty lamented, “came to NYC to watch Solana crash and burn. what a week.” Similarly, @kaitodelima shared, “No one escapes unscathed during a crash, but my losses aren’t too bad thanks to the previous airdrops that cushioned the blow.” Longtime crypto personality @TheCryptoLark highlighted the market’s broader social attitude, noting, “The sentiment in crypto is more bearish than when #Bitcoin was at $20,000.”

And of course, the memes were absolute fire. @DeFi_CPA posted a video of a man in a cowboy hat standing outside in hurricane Beryl, captioned “What it feels like to be in #NFTs and #Crypto right this month” while others shared numerous tried and true favorites.

Spoiler alert though: Crypto is not in fact dead. By July 8th, Solana had mostly bounced back, with social sentiment waffling almost immediately. @web3_actions optimistically posted, “seems to me the face-melting bull run is coming.” @XadeFinance encouraged, “There is no #cryptocrash. We will recover.”

At time of writing, Solana’s price is back up around $140, with some loudly anticipating higher prices in the only way they know how.

— Jeffrey Albus

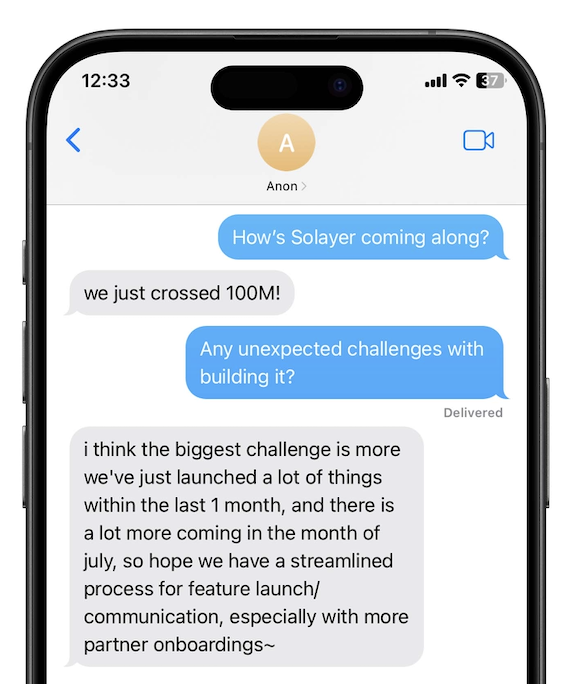

One Good DM

A message from an anonymous team member helping build Solana restaking at Solayer:

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the Forward Guidance newsletter.

Get alpha directly in your inbox with the 0xResearch newsletter — market highlights, charts, degen trade ideas, governance updates, and more.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.