LUNA Battles DOGE for Spot in Top 10; BTC Sells-off: Markets Wrap

LUNA battles DOGE for a spot in the top 10, BTC sells-off due to forced liquidations, Ethereum and Ronin dominate secondary NFT sales volume.

Terra LUNA Cryptocurrency. Bitcoin coin growth chart on the exchange, chart; Source: Shutterstock

key takeaways

- LUNA rallies in the face of a BTC correction, rivaling DOGE for a spot in the top 10

- BTC sold-off due to a spur of liquidations despite a compelling macro backdrop

LUNA is battling DOGE for a spot in the top 10 digital assets by market capitalization.

An overview of Terra and recent developments within the ecosystem.

Current supply dynamics of UST and LUNA as well as important risks to consider.

BTC crashes due to forced liquidations, marking the largest deleveraging event over the past six weeks.

Ethereum and Ronin dominate secondary NFT sales volume.

Latest in Macro:

- S&P 500: 4,538, -0.84%

- NASDAQ: 15,085, -1.92%

- Gold: $1,783, +0.79%

- WTI Crude Oil: $66.15, -0.53%

- 10-Year Treasury: 1.36%, +0.089%

Latest in Crypto:

- BTC: $53,697, -5.68%

- ETH: $4,224, -6.82%

- ETH/BTC: 0.0786, -1.48%

- BTC.D: 41.51%, -0.19%

UST/LUNA mint and burn mechanism

UST and LUNA are the two largest tokens within the Terra blockchain’s ecosystem. Terra’s UST is known as an algorithmic stablecoin that uses a process referred to as seigniorage, which means that to mint (create and put into circulation) new units of UST, the equivalent dollar amount of Terra’s native token, LUNA, must be burned (removed from circulation).

However, the system works both ways. If demand for UST begins to decline, then LUNA will be minted while UST is burned, which theoretically allows it to keep its value stable at around $1.

As demand for UST increases, it begins to trade at a premium and arbitrageurs purchase $LUNA on an exchange and burn it for UST to capture that spread and bring the peg back down to $1.

On the other hand, as demand for UST declines and trades at a discount, arbitrageurs can redeem their UST for LUNA in order to return the peg back to $1.

Recent developments

Prior to the Columbus-5 upgrade that went live on September 30, a large portion of burned LUNA would be rerouted to a community pool and the remainder would be burned. Since Columbus-5 went into effect, the community pool portion has been entirely burned as well, thus reducing the total supply.

This may leave investors wondering what happens to the funds that accrued to the community pool prior to Columbus-5. On Nov. 9, governance proposals 133 and 134 passed, which set forth the burning of 88.7 million LUNA in exchange for UST to bootstrap liquidity for an insurance protocol called Ozone. Terra Money announced on Twitter on Nov. 22 that the burn was completed, resulting in higher yields for stakers and $2.7 billion of UST being minted.

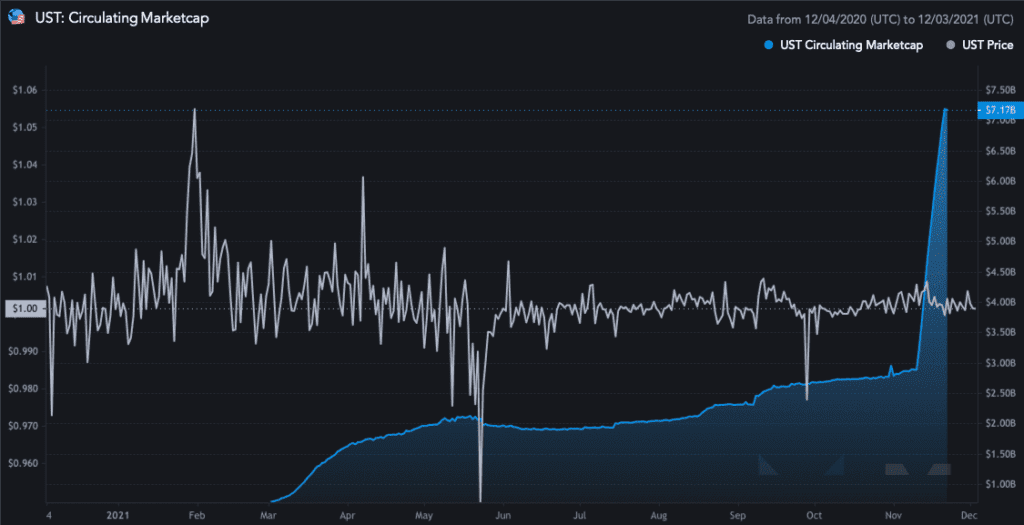

The UST supply has risen from $2.88 billion on Nov. 9 to $7.87 billion today, according to data from coinmarketcap. This places UST as the second-largest decentralized stablecoin behind Dai, which boasts a market cap of $9.184 billion, according to data from daistats.com.

The two largest stablecoins, Tether and USDC, have a combined market cap of roughly $113 billion. This is a testament to the size of the addressable market that stablecoins like Dai and UST are targeting.

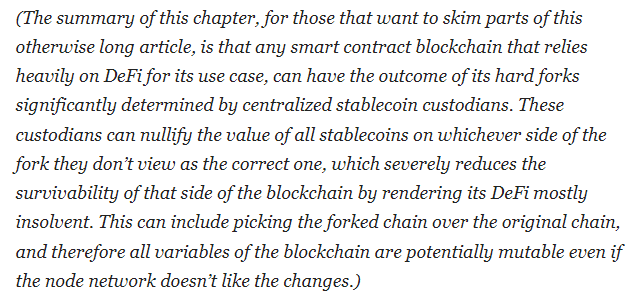

There are concerns over threats that centralized stablecoins pose to the broader digital asset ecosystem.

Lyn Alden, founder of Lyn Alden Investment Strategy, recently said, “I’ve seen a lot of people critique proof-of-stake but I’ve not seen many people point out that stablecoin custodians can basically decide the outcome of a hard fork for any blockchain that relies heavily on its DeFi ecosystem for its value proposition.”

Some other notable takeaways from the Columbus-5 upgrade include:

- Upgrade to Stargate to improve performance, add developer tools, and support more programming languages.

- Connecting Terra-based assets to the Cosmos ecosystem through the adoption of inter-blockchain communication (IBC).

- Integration of the Wormhole token bridge, which allows users to seamlessly transfer tokenized assets across Solana, Ethereum, BSC, Terra, and Polygon.

- Swap fees generated from the Terra Station wallet — Terra’s equivalent to the popular Metamask app and browser extension — which contains a built-in decentralized exchange, are now being distributed to stakers as well, rather than being burned.

Additional catalysts

- Highly anticipated protocol launches such as Astroport, Mars, and Prism that could lead to higher demand for UST and thus increase the amount of LUNA burned.

- The possibility of listings of UST and (or) LUNA on popular centralized exchanges such as Coinbase and Binance to further adoption.

- Neobank, Alice, which offers a ~20% yield on UST deposits that can be spent through a debit card, which would theoretically increase demand for UST.

- On November 9, Do Kwon announced initial plans to purchase $1 billion of BTC and other pristine digital assets to help increase adoption and confidence in UST.

- MIM-UST pool on Curve Finance.

Current LUNA and UST supply dynamics

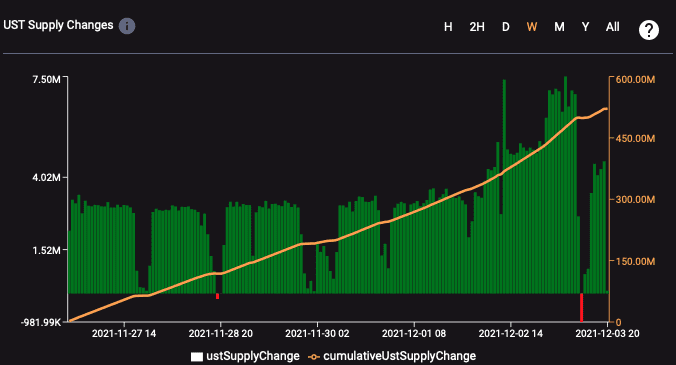

The amount of UST in circulation has been increasing over the past week by 3 million to 7 million per hour. A lot of this can be attributed to the aforementioned MIM-UST pool on Curve Finance, the UST Degenbox strategy, increased utilization on Anchor, and increased liquidity on Cosmos-based DEX, Osmosis.

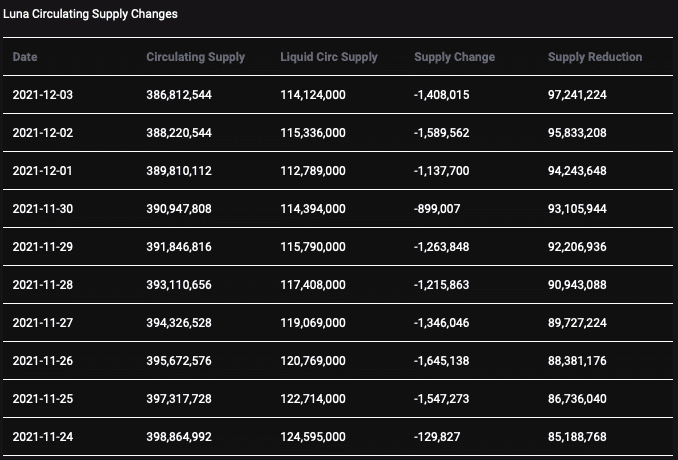

LUNA supply, on the other hand, has been contracting as a result. The amount of liquid circulating supply stood at ~124.6 million ten days ago, but is now at ~114.1 million which represents a decrease of roughly 8%. On Nov. 2, there was an uptick to the liquid circulating supply as a result of users unstaking their LUNA holdings.

For comparison, Ethereum has burned 1.1 million ETH since EIP-1559 went into effect in early August. That number represents a burn of less than 1% of its total supply of 117.8 million over the course of four months. It is worth noting that roughly 9 million ETH are staked and there is a lot of ETH locked in smart contracts, so it’s circulating supply is actually much lower.

When looking at the total LUNA supply over the past 10 days for a better comparison, the supply has dropped from 865.7 million to 853.2 million; a decrease of 1.4%. The massive burn rate is likely the reason for LUNA’s price rally.

On a day where BTC is down over 6%, LUNA is up 1.6% near $65. At this price, LUNA has a market cap of $25.9 billion as it tries to overtake Dogecoin (DOGE) as the 10th largest digital asset with a market cap of $26.1 billion.

Risks

The main risk associated with holding assets within the Terra ecosystem is the deviation of UST from its $1 peg to the downside.

In May of 2021 when digital assets crashed, UST holders were spooked and there was a roughly 25% contraction in the circulating supply which led the price of UST to drop below its $1 peg.

This type of bank run on algorithmic stablecoins is often referred to as a “death spiral,” where the entire economy crashes to zero. This has happened to numerous algorithmic stablecoins in the past.

“The reason why Terra has been resilient during market contractions is because there is a vibrant economy that is being built on the Terra blockchain and I think that’s the best defense that algorithmic stablecoins can have against death spirals,” said Do Kwon, co-founder of Terra, in a podcast.

Another risk is potential regulation. Gary Gensler, Chairman of the SEC, recently said, “These stablecoins are acting almost like poker chips at the casino right now.” The OCC, FDIC and the President’s working group on financial markets recently released a study on stablecoins in an effort to provide more clarity.

One positive development on the regulatory front was when Federal Reserve Chairman, Jerome Powell, came out at the end of September saying that he has no intentions of banning stablecoins. The chairman was just renominated to serve a second term, Blockworks previously reported.

BTC hopium

While BTC price action has been ugly today, the number of entities holding less than 1 bitcoin recently topped 5% of the supply, according to Glassnode. While day-to-day price action can be unnerving, adoption continues to thrive.

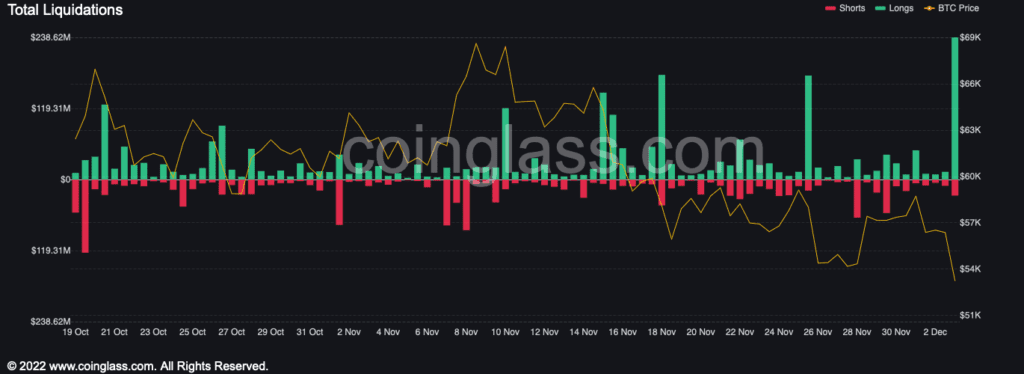

“While funding rates are only showing a slightly positive bias when compared to the end of October run-up, the vast amount of derivatives-based open interest displayed above leaves the door open for a leverage washout of the shorts or the longs. In short, liquidations could spur an explosive upwards or downwards move but only time will tell which way it unfolds,” I wrote in yesterday’s Markets Wrap from Blockworks.

That is, in fact, what happened, and unfortunately for BTC investors, the move went to the downside. According to data from coinglass, there were over $230 million of long positions wiped out today. This marks the largest deleveraging event over the past six weeks.

Non-Fungible Tokens (NFTs)

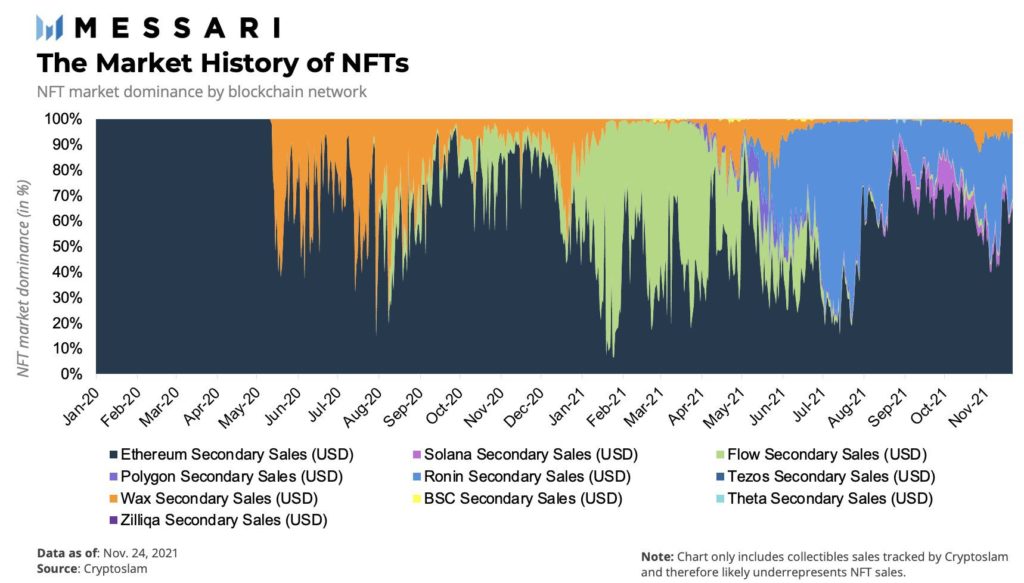

Ethereum and Ronin (home to Axie Infinity) are dominating secondary NFT sales volume, according to data compiled by Messari.

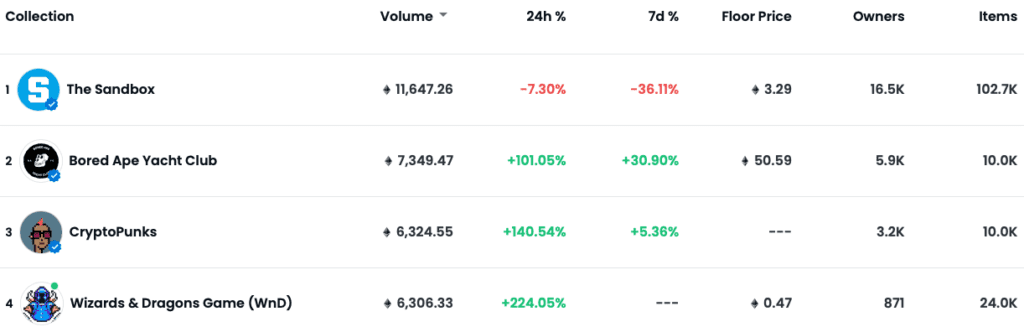

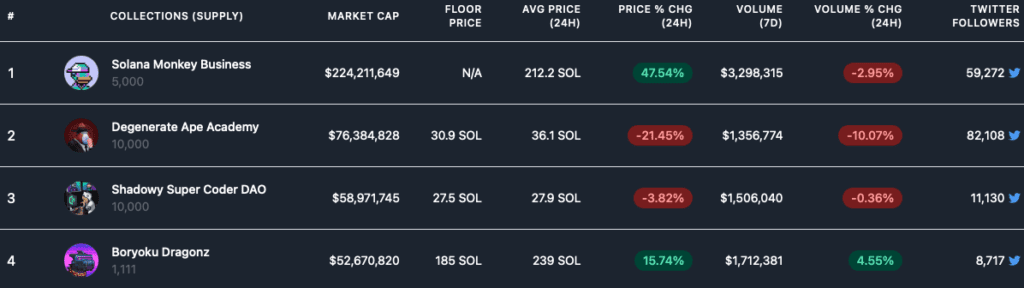

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up on Monday.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.