OFAC Sanctions’ Impact on Crypto Crime a Mixed Bag, Chainalysis Finds

Tornado Cash’s inflows fell 68% in the 30 days after sanctions, while average monthly inflows into Russia-based Garantex following its sanctioned designation more than doubled

solarseven/Shutterstock.com modified by Blockworks

The US government’s crypto-related sanctions last year have had mixed results on crypto crime, according to a new report by Chainalysis.

Decentralized mixing service Tornado Cash’s inflows fell 68% in the 30 days following its sanctions designation by the Office of Foreign Assets Control (OFAC) in August, for example. But Russia-based crypto exchange Garantex’s average monthly inflows more than doubled after implementing sanctions against it last April, Chainalysis data indicated.

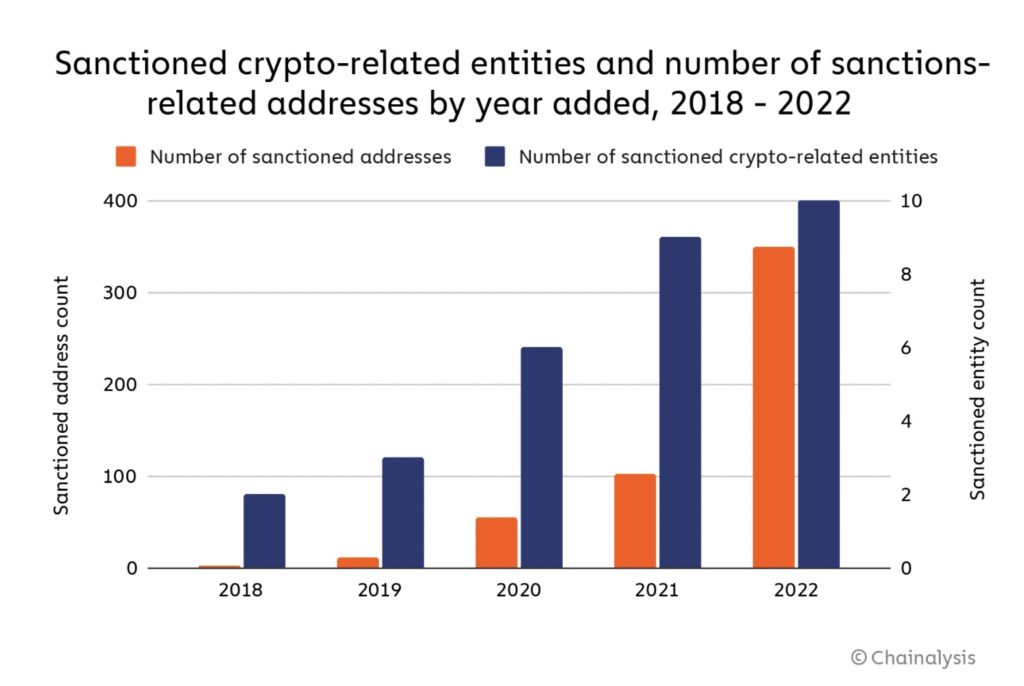

OFAC had sanctions against 10 crypto-related entities and about 350 addresses last year — both up from the prior year.

The Chainalysis report highlighted sanctions against darknet market Hydra, Tornado Cash, and Garantex as the most notable.

Garantex and Hydra received funds from various illicit actors in the 60 days leading up to their sanctions designations, including fraud shops, scams and ransomware.

“During this time period, Hydra received roughly $176,000 worth of cryptocurrency from ransomware addresses, representing 2.2% of all funds sent by any ransomware address,” the Chainalysis report states. “Garantex was even worse, taking in $931,000 from ransomware addresses, or 11.6% of all funds sent by ransomware addresses.”

Hydra’s inflows dropped to zero when sanctioned due to a law enforcement action seizing Hydra at the same time.

In the four months up through April, when Garantex was sanctioned, the high-risk exchange had averaged $620.8 million in monthly inflows. After the sanctioning event, Garantex’s inflows rose considerably, with an average of $1.3 billion in monthly inflows through October.

“This is most likely due to the fact that Garantex and most of its users are based in Russia,” the report states. “The Russian government has not enforced US sanctions, leaving users not subject to US jurisdiction with virtually no incentive to stop using Garantex.”

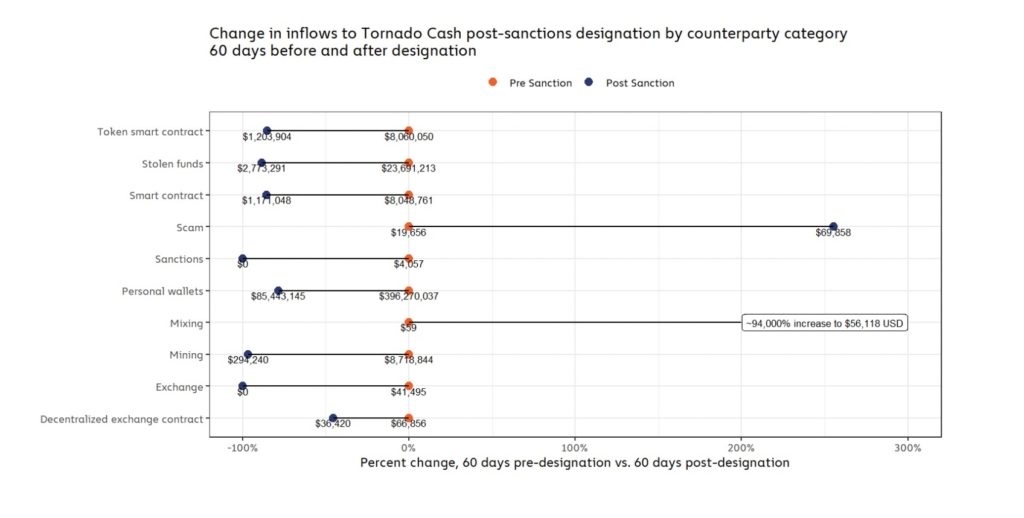

As for Tornado Cash, illicit activity associated with the mixing service was concentrated to crypto hacks and scams. The Harmony Bridge hack last June accounted for 65.7% of the mixer’s total stolen fund inflows during the 60-period before OFAC initiated sanctions against Tornado Cash.

Tornado Cash’s activity dropped significantly after being sanctioned, but it hasn’t ceased completely. Its inflows fell 68% in the 30 days following its designation.

“While its front-end website was taken down, its smart contracts can run indefinitely, meaning anyone can still technically use it at any time,” the report said of Tornado Cash. “That suggests sanctions against decentralized services act more as a tool to disincentivize the service’s use rather than cutting off usage completely.”

Sanctions against money laundering services have disrupted the illicit entities who relied on those services, at least temporarily, the report found.

Cybercriminal administrators were most impacted by the sanctions against money laundering services they had used, seeing an average estimated $750,000 decrease in revenue.

Fraud shops bucked the trend, with nearly $5,000 in more revenue than estimates, absent the sanctioning of a money laundering service counterparty.

But the sanctions also adversely impact lawful users of privacy protocols like Tornado Cash, which provides law-abiding citizens a means to protect the privacy of their financial transactions otherwise immutably recorded on the Ethereum blockchain.

Tornado Cash allows users to save encrypted receipts that prove the source of funds in response to legal requests for information from government authorities.

The blanket OFAC sanction on the protocol’s smart contracts also created new burdens for past users of the privacy tool — burdens that are being challenged by DeFi advocates in court.

One of the protocol’s software developers — Alexey Pertsev — has been languishing in a Dutch jail since August, without formal charge.

Macauley Peterson contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.