POW Isn’t Dead: Merged Mining Solves Bitcoin’s Energy Problem

Bitcoin mining is at a historical level of unprofitability, but merged mining strategies could change the game

Source: DALL·E

Bitcoin’s novel proof-of-work (PoW) consensus model is a technological marvel. It enabled the world’s first decentralized monetary system and paved the way for new distributed technologies underpinning a $1 trillion industry. However, several factors currently threaten the existence of PoW, leading to historically low levels of bitcoin mining profitability, high energy consumption and concerns about the network’s long-term survival.

Satoshi Nakamoto and many of the founding members of the bitcointalk forum foresaw these challenges. Satoshi proposed a solution that envisioned a multichain ecosystem operating symbiotically. Merged mining — initially implemented by Namecoin in 2011 — has been used in various consensus mechanisms.

Syscoin is one of the first blockchains with smart contract functionality and Ethereum virtual machine-compatibility, to use merged mining. This means that Solidity/Ethereum developers can build on a blockchain with security imported from the bitcoin mining network. Their unique approach solves two critical problems in the fragmented crypto ecosystem. First it offers the Bitcoin network a path toward sustainability and profitability. And secondly, its virtual machine capability provides a base layer of programmability that can scale beyond the constraints and security vulnerabilities of Ethereum’s application network.

Why bitcoin mining profitability is in decline

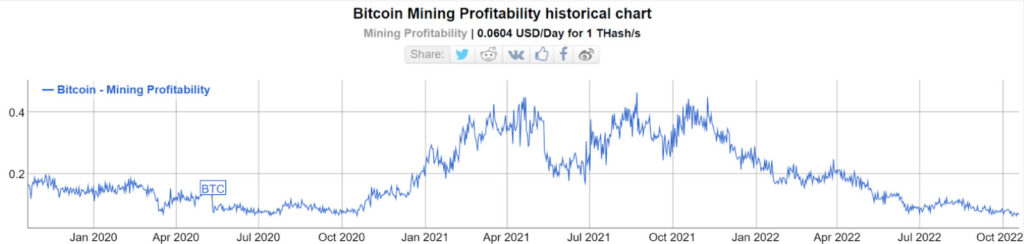

Bitcoin mining is at historical levels of unprofitability. Miners currently earn 0.064 USD for one terahash per second, a figure that drops below levels last seen in October 2020. On a broader scale, it could take up to 11 months for a large-scale mining operation to break even and 15 months for a retail miner to achieve the same feat.

Despite the decline in bitcoin’s price, miners haven’t stopped or slowed down production — in fact they have increased it. When the network adds more computing power, the protocol makes mining more difficult, and therefore expensive.

Increased participation is an indication that miners either believe that the hashrate will eventually drop from miner capitulation — resulting in lower energy costs — or the BTC price will rise to a level profitable to miners, or a combination of both.

For capitulation to occur, the network needs bloated and over-leveraged mining operations to go out of business. In the previous cycle, miner capitulation occurred between November 2018 and January 2019, triggering a sell-off that correlated with a bottom in bitcoin’s price.

The difficulty and hashrate decreased, and profitability spiked later in June 2019. But more importantly, miners who survived that capitulation received the highest returns for the BTC they mined at the bottom of the market.

Miners today believe that surviving these historic levels of unprofitability will result in similar returns in the future. But this trajectory of parabolic growth becomes increasingly difficult to maintain as bitcoin loses market dominance to competing digital assets. And the halving cycle only exacerbates this problem by cutting block rewards in half every 4 years.

Read more: Is Bitcoin Mining Still Profitable? The Economics Explained

If bitcoin is unable to achieve another parabolic rise after the next halving cycle, then miner capitulation may happen en masse, triggering a deleveraging pattern that represents a fundamental departure from the bitcoin mining business model. Instead of trying to be the last miner standing in periods of unprofitability, miners will try to avoid the effects of the halving cycle by being the first to leave.

This scenario, though, can be avoided if miners find alternative revenue sources for their mining equipment.

Bitcoin’s energy consumption concerns

Bitcoin has seen increasing backlash for its energy usage following Ethereum’s switch to proof-of-stake (POS). Some climate groups have called for Bitcoin to move away from PoW and retire the legacy consensus model.

Many of these criticisms ignore that the need for cheap energy incentivizes greater efficiency over time. And Bitcoin’s POW represents a small percentage of energy compared to the energy consumed by industries like gold mining, paper currency and banking. Despite the overblown concerns, the growing perception around POW puts immense pressure on bitcoin miners. The network needs to address the energy consumption criticisms or risk governments taking significant measures, such as outlawing mining if energy costs keep rising.

Ideally, bitcoin miners require more favorable dynamics to maximize investment returns. Relying on unlikely scenarios such as miner-friendly government regulations and increased transaction fees on the network does not suffice. Instead, the solution to reduced bitcoin mining profitability and energy concerns could lie somewhere else — in the concept of merged mining.

How merged mining solves Bitcoin’s energy problem

Merged mining, also known as auxiliary proof-of-work (AuxPoW), is a mechanism that allows miners to mine multiple networks without additional energy usage. In the case of Bitcoin, miners can submit proof-of-work already performed on the parent network (Bitcoin) to validate blocks on an auxiliary network.

The auxiliary network inherits Bitcoin’s robust security model and is more resistant to 51% attacks. In return, miners receive lucrative rewards in the form of coins from the auxiliary network, thus subsidizing costs associated with their mining operation.

Merged mining solves Bitcoin’s energy problem by ensuring that computational power is reused to incentivize miners and underpin another network. The auxiliary network is effectively carbon neutral, as miners do not expend additional energy resources.

Merged mining can help prevent major deleveraging by offering miners an easy and reliable second income stream from block subsidies.

When Satoshi Nakamoto first envisioned the concept of merged mining, he described a mechanism that allows a separate blockchain to “share CPU power with Bitcoin.” Fast forward to the present, and about 20%-30% of the global Bitcoin hashrate simultaneously mines Syscoin. This not only provides a second income, but it also provides a base for the network to power other use cases beyond Bitcoin’s primary utility as a worldwide monetary system.

Syscoin, in combination with Jax.Network, is launching the Global Merged Mining Alliance (GMMA), to bring more awareness to merged mining and expand Bitcoin’s network.

Dylan Stewart from Syscoin said, “We believe in merged mining and would like to see wider adoption and consideration beyond ourselves. This also should garner appeal for every mining pool not currently taking advantage of it due to the essentially free income they’re foregoing by not participating, especially in the wake of many operations currently being unprofitable due to energy costs.”

How Syscoin delivers a secure and scalable blockchain application layer

Syscoin takes a novel approach to solving the famous blockchain trilemma (i.e., decentralization, security, scalability). At the base layer, Syscoin benefits from Bitcoin’s substantial decentralization and security model through merged mining. Syscoin further implements Chain Locks, an industry-accepted solution that mitigates 51% attacks through independent verification by masternodes.

As an Ethereum virtual machine-compatible network, Syscoin achieves scalability through a native implementation of rollups. Rollups support off-chain computation and chain-state storage, allowing applications to process thousands of transactions per second while posting only minimal data to the mainnet.

Syscoin also scales through Valadium – another roll-up-centric solution that can theoretically handle over 9,000 transactions per second per rollup through off-chain data availability. Hundreds, if not thousands, of rollups can run off of the Syscoin network in parallel independence. In addition, they engineered Proof-of-Data Availability, a new standard aimed at making Valadium a more reliable and censorship resistant solution for financial applications.

“Currently, Ethereum is the only other chain we know of to be working on this in the form of Proto-Danksharding, a solution similar to ours we each arrived at in isolation, which speaks to the viability of it,” Bradley Stephenson of the Syscoin Foundation said, “However, Ethereum’s solution is at least a year away, and given the historical gaps between their roadmap and actual implementation, could very well be much longer whilst our solution is already on testnet.”

These scalability features enable Syscoin to power Web3 use cases, including DeFi primitives, gaming and NFTs.

Syscoin’s architecture demonstrates that Ethereum’s POS consensus model does not deliver the most environmentally friendly, secure and scalable solution. PoS networks notably have a lower carbon footprint (up to 99%). Yet, at best, they are less decentralized and fail to provide the same level of robust security as a PoW system such as Bitcoin.

“Proof-of-stake models have a tendency towards cartelization or centralization,” Syscoin’s Dylan Stewart explained. “This benefits the wealthiest ETHstakers at the expense of the poorer, a problem compounded by ETH’s already extremely inequitable distribution stemming from their pre-mine.”

Syscoin enables a carbon-neutral network that preserves Bitcoin’s time-tested security and decentralized model. It also supports the development of a network that handles transactions in a manner that reflects Satoshi’s initial vision of scalability.

This content is sponsored by Syscoin.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.