Is the Fed’s rate-cutting cycle over?

One key driver behind talk of a swift end to this cutting cycle is around surprisingly stubborn inflation

FOMC Chair Jerome Powell | Federalreserve/"October 2019 Federal Open Market Committee Press Conference_NZ70071″ (CC license)

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Back in September, the market priced one of the most aggressive cutting cycles I’ve ever seen, with multiple 50-basis point cuts priced in that would swiftly take us to 3% on the fed funds rate in 2025. Fast forward to today, and it’s a completely different story, with one to two cuts at best priced for 2025.

Let’s dig into what has driven the change and what to expect.

Below is a chart that compares the effective federal funds rate (EFFR) against the two-year Treasury note.

There’re a few takeaways we can grab from comparing these two yields:

- Throughout the last two years, we’ve seen many moments where the two-year has priced in an imminent and aggressive cutting cycle (as seen when two-year heads lower below EFFR).

- For the first time since mid-2022, we see these two yields are parity. This implies the market is pricing in a rate-cutting cycle that is essentially over, but it sees no chance of any hikes either.

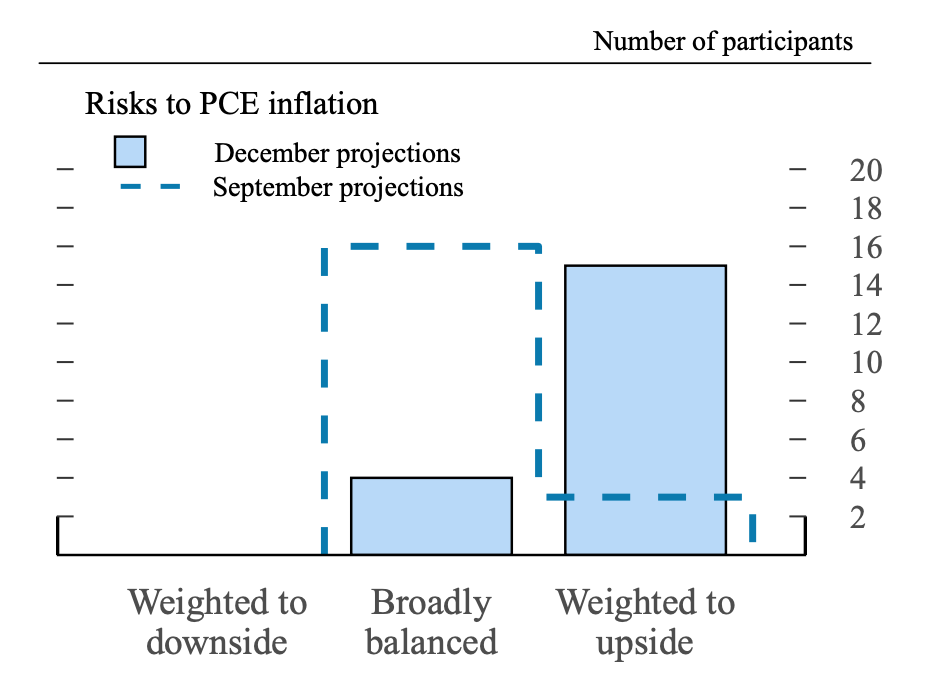

One of the big drivers behind talk about a swift end to this short-lived cutting cycle is around surprisingly stubborn inflation. As we can see in the December summary of economic projections, FOMC members have aggressively shifted from seeing inflation as being broadly balanced to seeing risks weighted to the upside.

This, paired with what is proving to be a much more resilient and solid labor market than what it appeared in September when the FOMC started to cut rates, is shifting the distribution of probable outcomes more toward a hawkish monetary reaction function.

Putting these pieces together shines a light on why there’s increasing conviction in the idea that the rate-cutting cycle is over.

That said, there are still dovish voices within the FOMC.

In his speech this week, Governor Waller mentioned he still believed in cutting this year: “So what is my view? If the outlook evolves as I have described here, I will support continuing to cut our policy rate in 2025. The pace of those cuts will depend on how much progress we make on inflation, while keeping the labor market from weakening.”

Much like the last two years, 2025 is shaping up to be another year of extremes where the market goes from pricing in aggressive hawkishness to aggressive dovishness.

Investors will need to quickly decide whether to try and ride these changes in sentiment or ignore them as noise.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.