Respect the PUMP: Crypto’s emerging meme season

Crypto is shifting into risk-on mode — pump.fun dominates meme activity, while Lido leans on treasury maneuvers

Greenni/Shutterstock and Adobe modified by Blockworks

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

With risk assets back in rally mode, crypto is leaning hard into the easing narrative. Softer inflation data has lifted expectations for Fed cuts, sending majors higher and reigniting speculative flows. In this environment, protocols are reaching for every tool available to capture attention and support valuations, from pump.fun buying ecosystem memes to Lido potentially experimenting with buybacks as a way to bolster token performance.

Market Update

It’s a field of green today with BTC, ETH and SOL up 2.3%, 1.7% and 2.7%, respectively in the last 24 hours. This follows the PPI surprising to the downside, falling 0.1% MoM vs a forecast +0.3%. Traders took it as proof that Trump’s tariffs aren’t fanning inflation.

All eyes now turn to tonight’s CPI print to confirm the trend and pave the path for rate cuts ahead. Current odds show an 82% chance of a 25bp cut next week, with even a 17% chance of 50bp cut. Expectations for three cuts this year have doubled since last week. The anticipation of an easing cycle has turned sentiment bullish, with Pump the standout performer, up 46% in the last seven seven days.

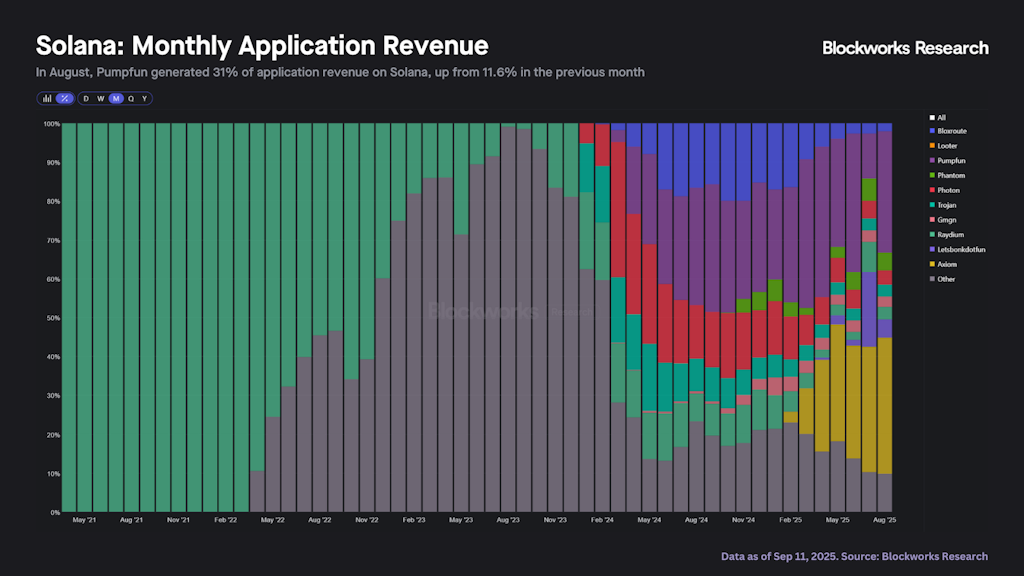

The easing cycle that began last September sparked Solana’s meme season, peaking in December 2024 when the Fed signaled slower cuts ahead. Potential airdrops from Meteora, Seeker, and maybe even Pump in Q4 could fuel the next wave. Historically, infrastructure plays like Raydium and Solana benefited most from meme trading, but flows now tilt towards Pump as a more direct play. In August, pump.fun drove 31% of Solana app revenue and currently dominates 92% of launchpad volumes.

Initially criticized as extractive, pump.fun has since emphasized community alignment. Its Glass Full Foundation injects liquidity into ecosystem tokens, while Project Ascend boosted creator earnings by 12x. Fading a project with PMF is a losing trade, and Pump keeps printing.

— Kunal

Lido: Buybacks without profits

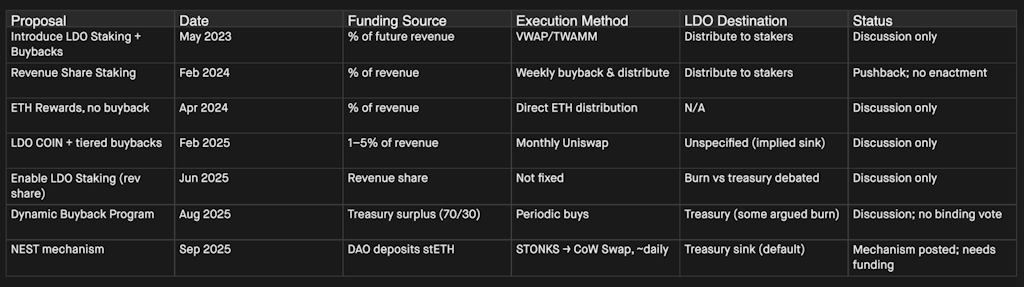

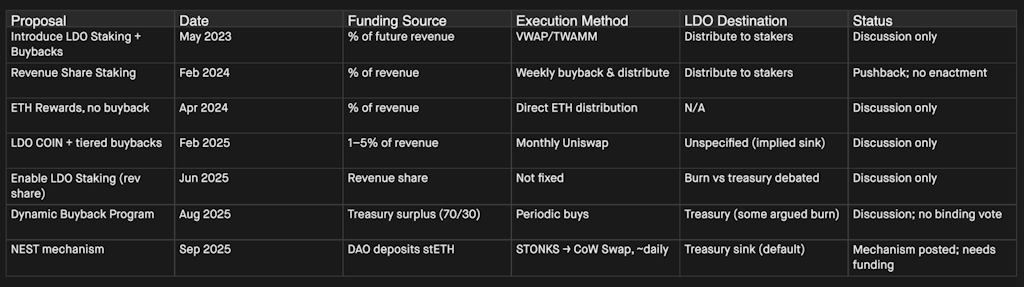

Lido contributors and Steakhouse have proposed NEST (Network Economic Support Tokenomics), a buyback sink that uses stETH set aside by the DAO to buy LDO. The mechanism operates as follows:

- Funding: The DAO fills NEST with a chosen amount of stETH via Aragon votes.

- Execution cadence: For any stETH held in NEST, at least one CowSwap order must be created every ~7,000 blocks (approximately once per day), with a maximum order size calibrated to stay under 1% slippage.

- Keeper incentive: Whoever triggers an eligible order receives two basis points of the order size in stETH as a reward.

Two factors make this proposal particularly interesting. First, Lido DAO will be responsible for filling and topping up the NEST contract with stETH, meaning the buybacks are uncorrelated from the protocol’s direct earnings, a contrast to the majority of programs that fund themselves with revenue. With Lido’s treasury holding 26,816 stETH ($115 million), although there’s no indication of how much will be deployed, it’s likely that holders will appreciate any form of financial engineering that could support price appreciation.

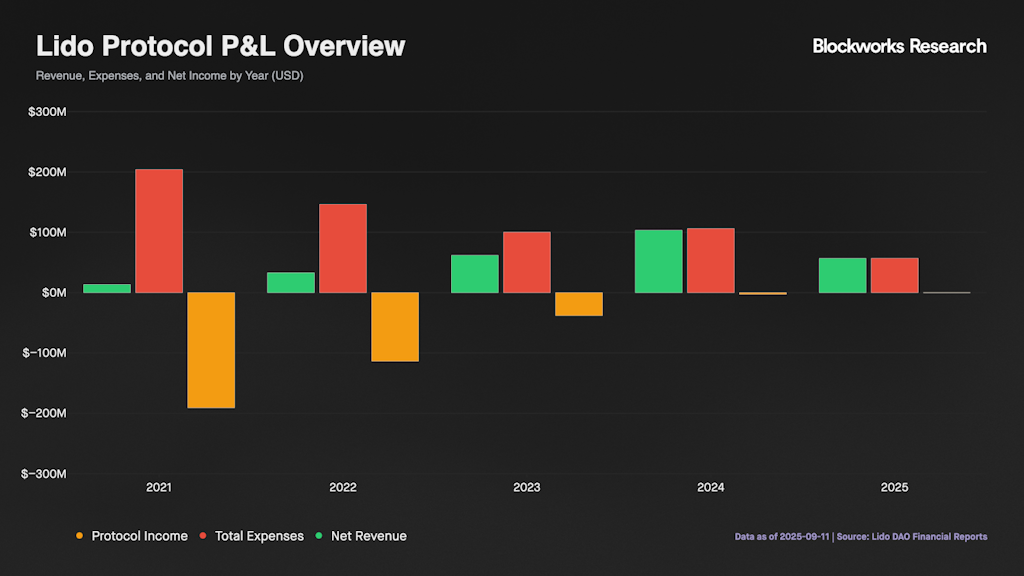

However, the irony is that Lido DAO has yet to turn a profit. The protocol has accumulated $345.4 million in cumulative losses since 2021, despite processing over $2.68 billion in gross staking rewards. While 2025 shows improvement with losses narrowing to just $200K (approaching breakeven), the fundamental economics remain challenging.

Interestingly, the topic has been discussed extensively before, particularly in 2024 after Uniswap’s fee switch proposal ignited a buyback meta among DeFi 1.0 projects. Hasu pushed back, arguing that revenues are insufficient to cover the runway and that the protocol should wait for profitability before implementing buybacks.

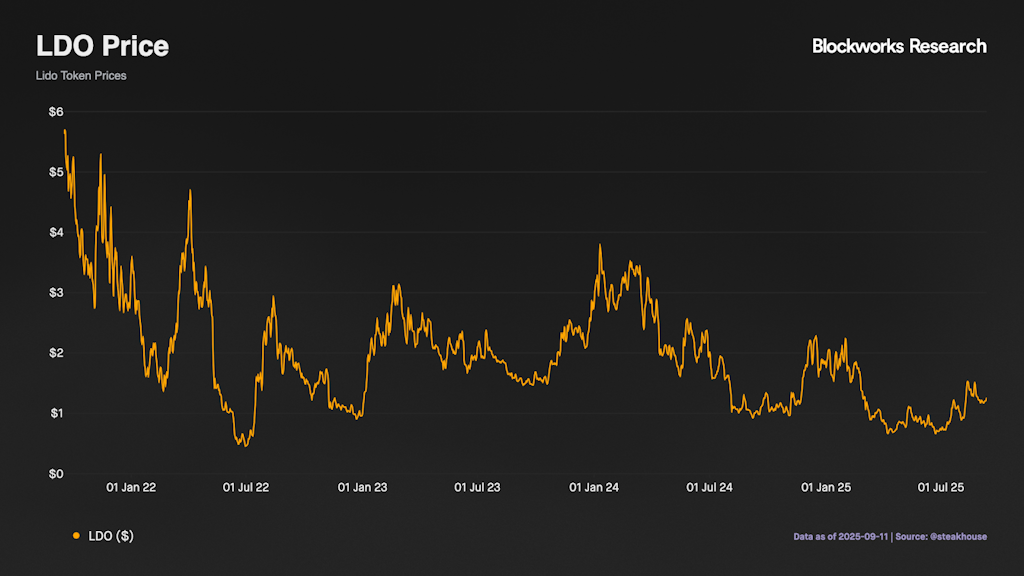

But with LDO trading 78% below its all-time high at $1.26, perhaps the DAO has grown tired of waiting. Watching the whole market pump, the prospect of deploying treasury assets to support token price may be more attractive than enduring another year of underperformance.

— Shaunda

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.