Sanctum V2 expands to Solana’s transaction delivery layer

Gateway wants to be the de-facto entry point for Solana

sanctum solana

This is a segment from the Lightspeed newsletter. To read full editions, subscribe.

Liquid staking is a winner-takes-all game.

Users want staking yield and instant liquidity; the first is an easy commodity to provide, the second is a tough distribution problem.

Each liquid staking token (LST) has to bootstrap deep pools and win listings across money markets, perps, routers and wallets so it can behave like “money.”

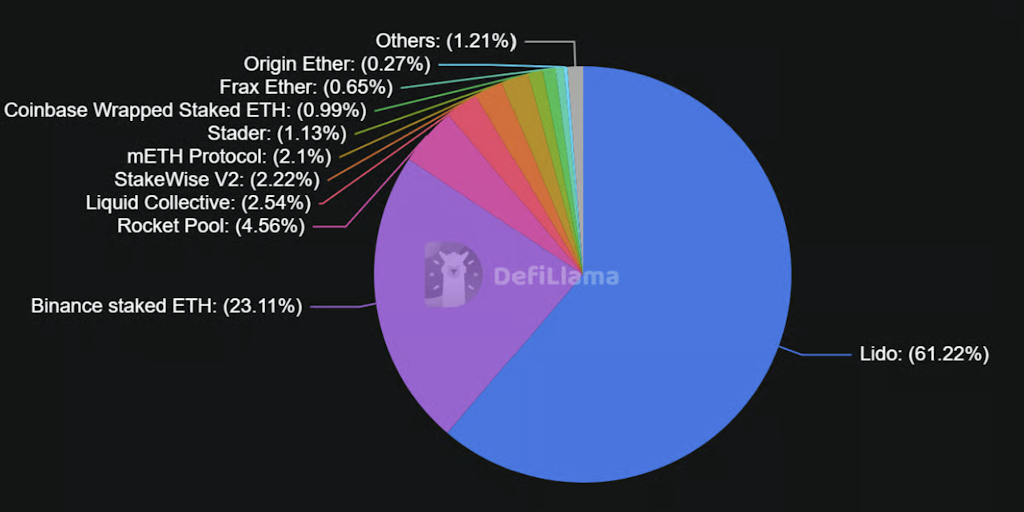

But liquidity begets liquidity — hence why Ethereum’s LST market has long been dominated by Lido’s stETH, followed by a long tail of smaller unsuccessful LSTs.

That same dynamic, however, does not play out in Solana, which has literally thousands of LSTs. That’s largely due to Sanctum, the team responsible for inverting the economics of LSTs on Solana.

How does Sanctum do it?

Sanctum (formerly Socean) provides a white-label issuance service for anyone to launch their LST, and a shared liquidity reserve that any LST issuer can plug into.

This shared reserve enables anyone with SOL to launch their own branded LSTs without worrying about having to raise a giant SOL buffer to meet redemptions.

Sanctum’s co-founder FP Lee told me: “Liquid staking on Solana works differently from liquid staking on Ethereum due to some technical reason with state accounts.”

“I saw a future whereby, as long as you build a unified liquidity layer, that the marginal cost of creating your LST will be zero, and therefore there’ll be a thousand LSTs eventually.”

To facilitate swapping between thousands of LSTs is where Sanctum’s own AMM “Router” comes in.

Swaps on Sanctum’s Router don’t rely on liquidity depth as is typical on AMMs. It simply moves underlying stake positions at intrinsic values, similar to how a bank’s clearing network works, letting Sanctum net a small fee. That effectively allows the swapping between LSTs without bonding curves or impermanent loss.

When necessary, swaps can tap into its reserve or the “Infinity” shared pool where thousands of LSTs sit. Here Sanctum takes a small fee and routes it to INF, Sanctum’s yield-bearing product that consists of a basket of whitelisted LSTs.

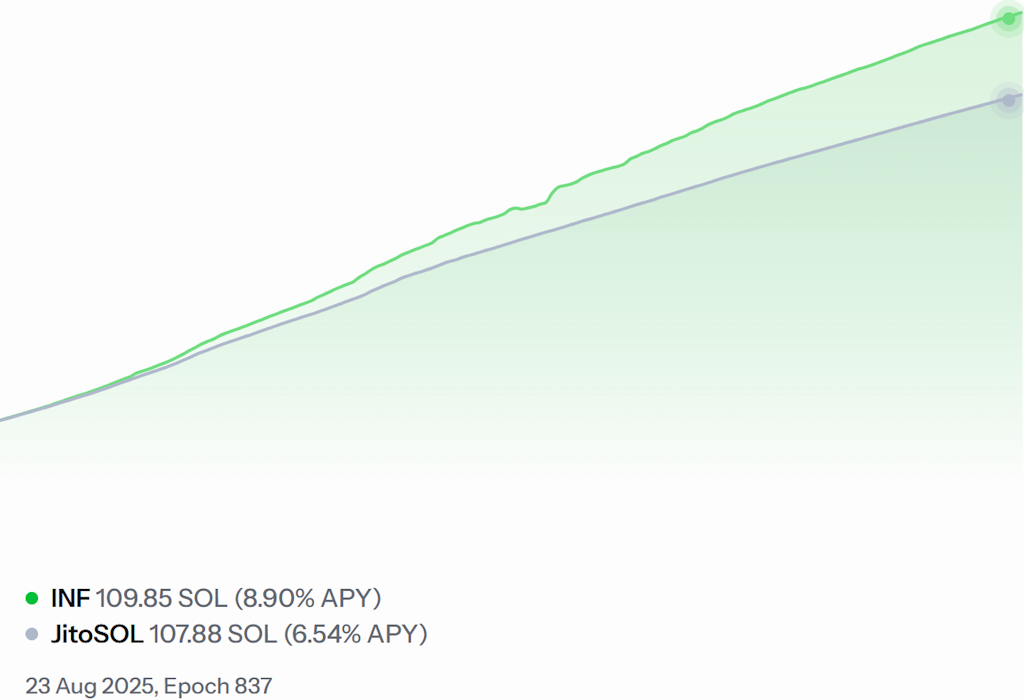

This additional revenue stream is why INF’s yield has historically outperformed even the yield of Solana’s dominant LST, JitoSOL.

INF is commonly referred to as a “LST-of-LSTs,” but it is really more akin to a yield-bearing strategy that involves trusting Sanctum’s curation.

In sum, Sanctum socializes the hard parts of the LST business (depth, redemptions, routing) so everyone can launch an LST and ride the same liquidity engine. Then it builds a superior yield-bearing product on top of everything. Voila.

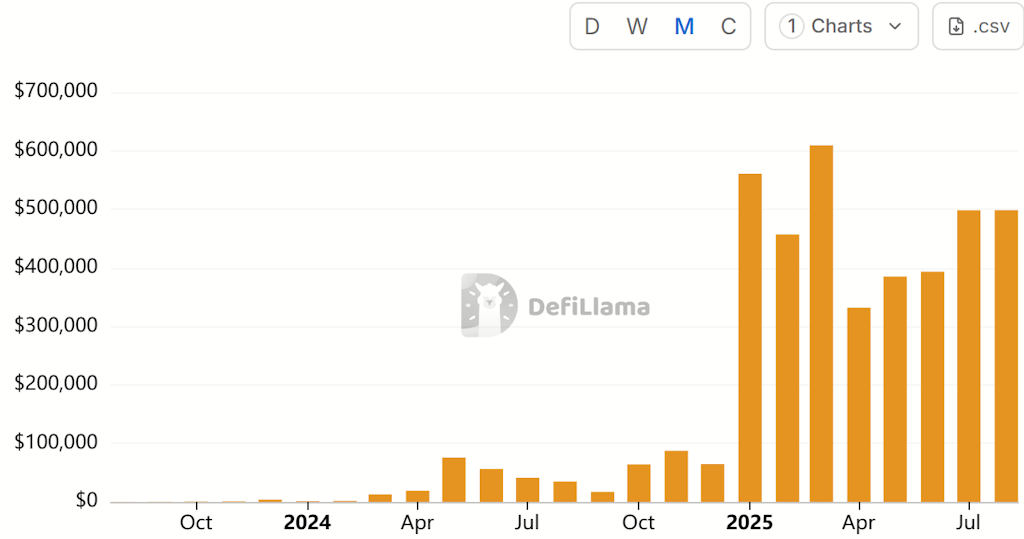

You wouldn’t guess it from the price action of its CLOUD native token (don’t look), but Sanctum is one of the rare few revenue-generating teams in the industry. Sanctum’s vertically integrated liquid staking product suite has generated substantial revenues, about $5.9 million annualized off this month.

Now the team is expanding beyond liquid staking. Sanctum’s v2 revamp yesterday unveiled officially a broader push into Solana’s transaction-delivery layer.

At the center is Gateway, a “transaction delivery aggregator” that builds on its acquisition of the DevOps infrastructure platform Ironforge last month. Gateway is designed to improve transaction inclusion with full-stack transaction observability of RPC providers.

Gateway works by routing through multiple providers (RPCs, Paladin, Temporal, etc.) and will use pay-as-you-go pricing with tips, rather than an upfront subscription.

The goal is to become the “de facto entry point” for Solana, Lee told me.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.