Shiba Inu Owner Moves $2.76B to Four Different Wallets

Transfer of over 40 trillion tokens went to wallets with no prior token transfers.

Source: Shutterstock

key takeaways

- The owner of the wallet with $5 billion in Shiba Inu coins has begun transferring the funds to different wallets

- By the time all 40.004 trillion tokens were transferred, the owner had moved about $2,760,000,027.60 worth of Shiba Inu

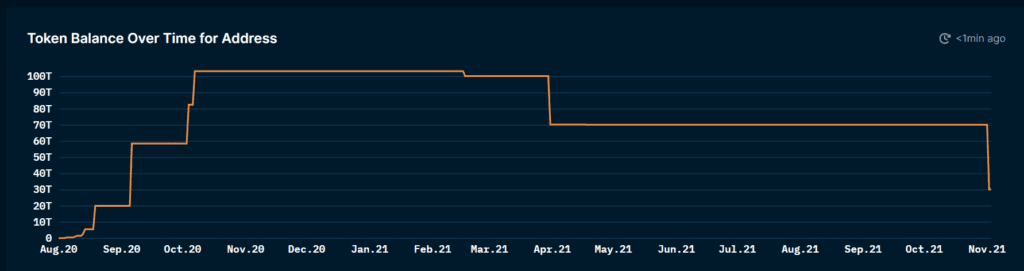

An investor who bought $8,000 worth of Shiba Inu cryptocurrency in August 2020 has transferred over 40 trillion tokens from their wallet — about $2.76 billion, according to their Etherscan account.

The transfer sent approximately 10,000,000,100,000 Shiba Inu tokens to four different wallet addresses over four transactions. All four of the addresses the tokens were sent to have no prior token transfers.

Since the transfers, the token price has dropped 1.91%, a small amount in relation to typical market volatility.

The transactions occurred between 6:20 pm and 6:45 pm ET Tuesday. Each transfer was roughly $600 million, or about 10 trillion tokens. At the time, Shiba Inu was at $0.000069 per token.

By the time all 40.004 trillion tokens were transferred, the owner had moved about $2,760,000,027.60 worth of Shiba Inu.

The transactions come one day after Shiba surpassed Dogecoin and became the tenth most valuable digital asset by market value of $40 billion. The cryptocurrency saw its biggest rally in late October when it surged 66% in one day.

The so-called meme coin is up 103.2 million percent over the past 12 months. Its price is still up 42.26% on the week and 760.93% on the month, according to Coinbase data.

Stay up to date on the crypto and macro markets with the Blockworks daily newsletter. Sign up today.