The ongoing TradFi bids to enhance markets via blockchain tech

Nasdaq’s proposal to tokenize securities follows Fidelity’s first tokenized investment product

Kirkam/Shutterstock and Adobe modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

A Monday Nasdaq filing seems to affirm what many of you may have read previously: Tokenization could transform finance sooner than many think.

In a proposal to the SEC, the exchange seeks to let firms and investors tokenize the equity securities and ETPs they currently trade on the Nasdaq.

More specifically, the approach would allow participants the choice (upon entering an order) to have the Depository Trust Corporation (DTC) clear and settle trades in tokenized form.

Nasdaq noted that tokenized securities are “technologically distinct” from those traded on the exchange today (blockchain tech can offer faster settlements, improved audit trails, etc). But the company emphasized that both the traditional and tokenized types of shares would have the same value, rights/benefits, and market identification number.

Integrating digital assets into Nasdaq’s existing infrastructure “will advance financial innovation while maintaining stability, fairness and investor protection,” the exchange’s VP of North America said in a statement.

Ondo Finance chief strategy officer Ian De Bode said the filing reinforces the vision that blockchain tech can enhance traditional markets while preserving what makes them trusted.

“The same rails that gave people global access to the US dollar will now give global access to US capital markets,” he added.

This filing comes a bit more than a month after SEC Chair Paul Atkins’ made his “Project Crypto” pronouncement — an initiative to let the US financial markets move onchain. The agency then issued a couple joint statements with the CFTC last week, promising collaboration that fosters innovation:

With a household name in finance getting on the tokenization train, let’s mention another that has jumped on the bandwagon.

Fidelity launched its Treasury Digital Fund (FHYXX) in December before filing for its OnChain share class in March — allowing it to use both traditional book-entry form and blockchain tech to record share ownership on Ethereum. The new share class went live last month.

This is Fidelity’s first tokenized investment product — following fellow TradFi behemoths like Franklin Templeton and BlackRock into this realm. Its blockchain representation, the Fidelity Digital Interest Token (FDIT), can be bought/redeemed through Fidelity Investments.

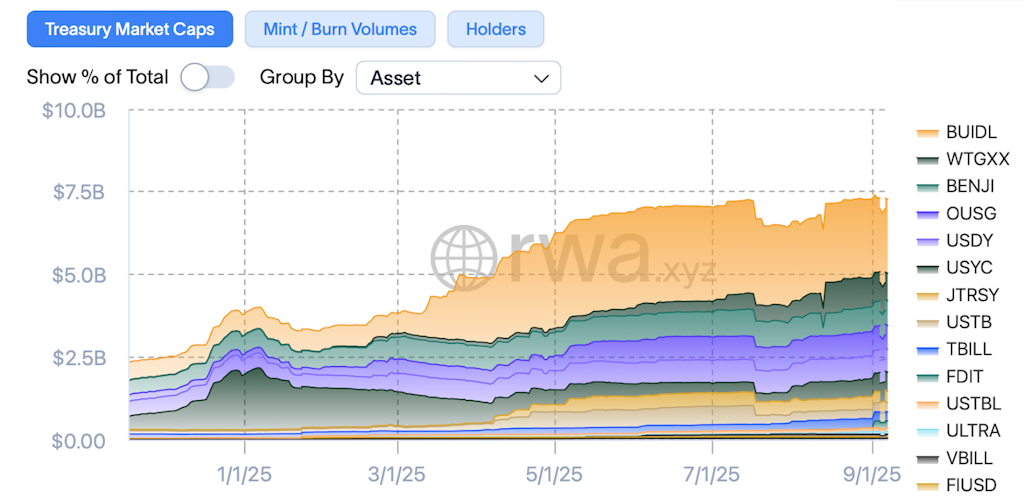

The combined assets under management in BlackRock’s BUIDL, WisdomTree’s WTGXX and Franklin Templeton’s BENJI make up more than half the $7.4 billion tokenized treasury space. FDIT, in its early days, manages roughly $200 million.

Basically, FDIT is a step toward the company building out more efficient systems and interoperability between traditional and onchain investors. Fidelity and other aforementioned financial giants clearly view yield products as a good way to start.

Fidelity’s Cynthia Lo Bessette told me: “Longer-term, we anticipate that market infrastructure will integrate tokenized assets, which will reshape market structure and create new opportunities for investors to access broader asset classes and personalize portfolios.”

And that expectation brings us back to what Nasdaq is trying to do. In other words, more of the financial world is getting on the same page.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.