Unpacking the Santa rally that never was

Going into an FOMC meeting, a constellation of factors come together to affect the event’s price outcome

solarseven/Shutterstock modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

So the Fed cut rates by 25bps yesterday and markets threw a fit. Hell, we even ran a headline talking about a Santa rally that was about to ensue. Whoops. It happens.

But what gives? What actually happened? Let’s break it down.

Going into an FOMC meeting, a constellation of factors come together to create the tension that leads to the price outcome of the event. This combination of the market’s expectations is based on the FOMC’s forward guidance (the name of this newsletter!) and the positioning of market players going into the event with respect to those expectations. Let’s break the two down.

Expectations

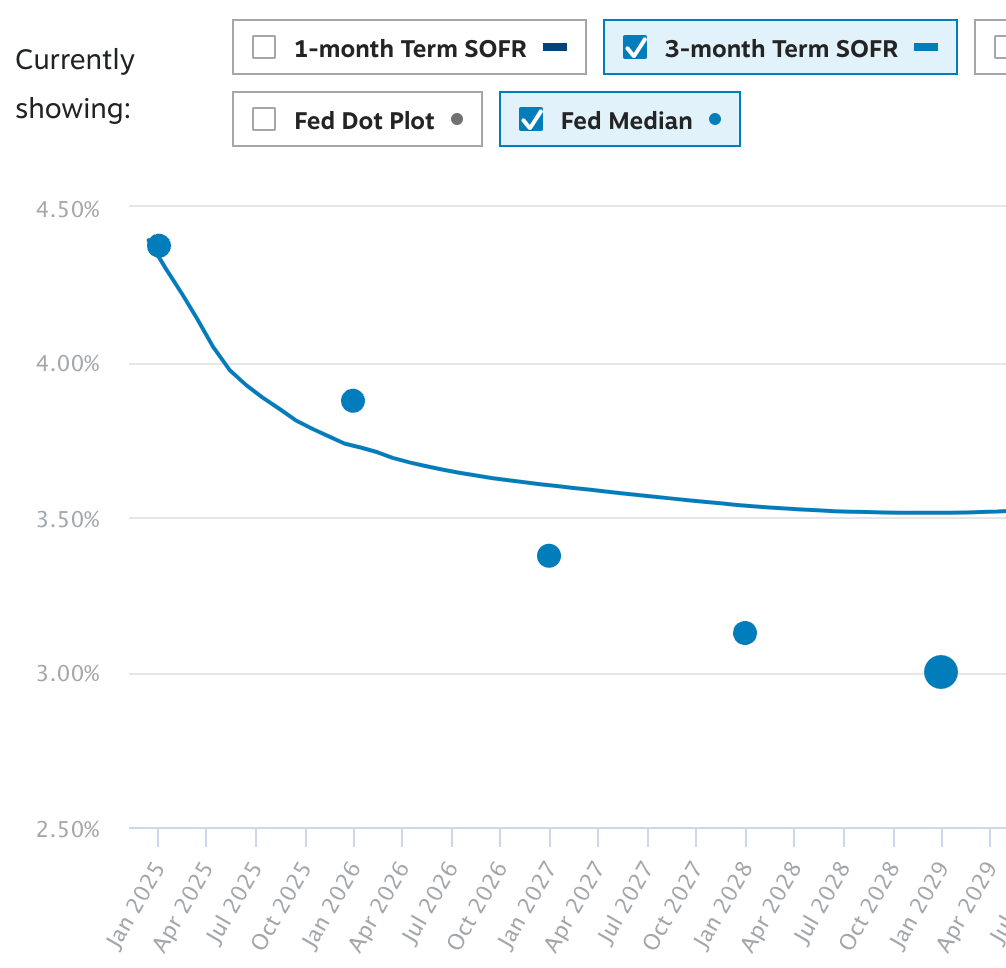

Going into the meeting, the SOFR curve, which can be considered the market implied forecast of the fed funds rate path toward its terminal rate, had departed significantly from the Fed’s previous summary of economic projections forecast from September.

This largely reflected a major phase shift upward in economic strength and resilience of the labor market, requiring less rate cuts than what everyone expected in September.

In 2025, the market was only anticipating three-ish rate cuts. Therefore, to surprise the market to the hawkish side of things, the hurdle was very high to achieve this.

To my surprise, the FOMC managed to do it while also cutting rates yesterday. A hawkish cut? What a time to be alive.

By moving up the expected fed funds rate to 3.9% (from 3.4%), the FOMC forecasted only two cuts in 2025 vs. the already hawkishly positioned market that expected three.

This decrease in the amount of cuts was largely driven by increased uncertainty on the path of inflation in the next 12 months, as seen here:

All of that information got distilled into this simple move — the second dot here moving above the market’s expectation in 2025:

Now what made this move so brutal yesterday? The second part: positioning.

Positioning

There’s a trifecta of positioning dynamics that came together to lead to the perfect kindling, sparking the fire that was yesterday. As Tyler Neville (co-host of the roundup) discusses here, with the VIX being so low into the event, the systematic crowd was aggressively long:

Further, there were widespread expectations of seasonality dynamics in markets (i.e. the Santa rally we alluded to yesterday) to take us to the promised land. This led to everyone piling in on the same trade of longing high beta risk assets under an assumption of continued dovishness from Powell.

Finally, we have the largest options expiry in history happening this week. With such large open interest, dealers who have to hedge their delta exposure end up chasing gamma in a reflexive manner that amplifies moves in markets. This further led to yesterday’s acceleration.

As always, there’s no single cause for market moves on any day. More so, it’s the constellation of a variety of factors that come together to cause the outcome. And some days those end up being quite aggressive moves, like we saw yesterday.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.