Polymarket performs smoothly on Election Day, processes $240M in trading volumes

Polymarket’s underlying blockchain chugged along more or less smoothly, processing 2,921,668 transactions on election day

Polymarket and Adobe Stock modified by Blockworks

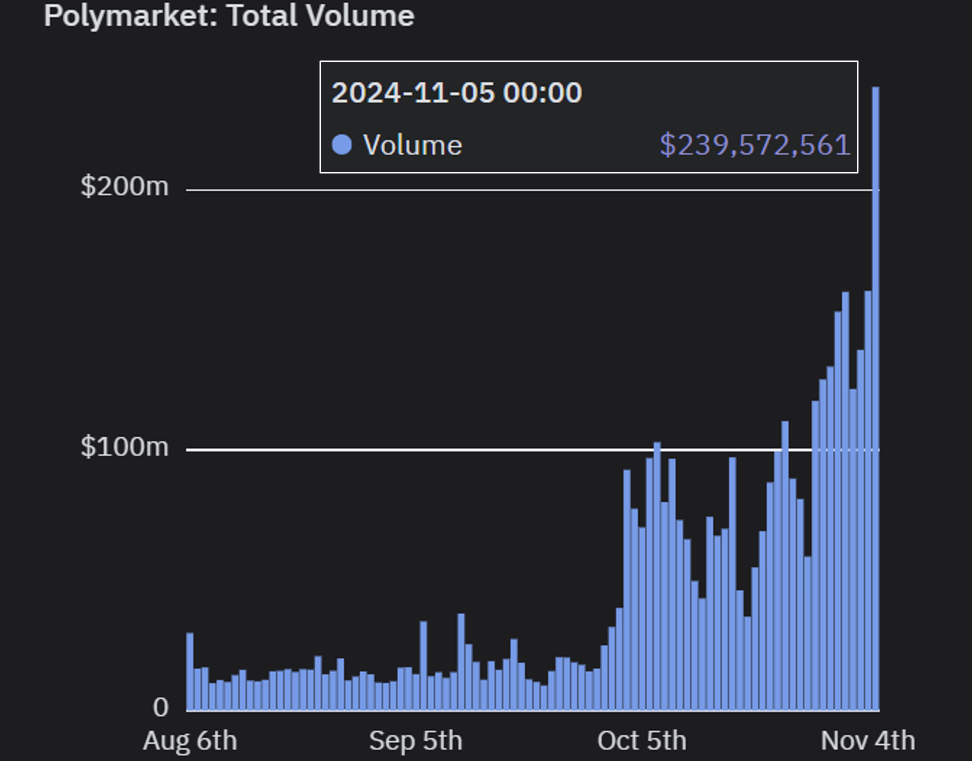

On the most important night of the year for Polymarket, crypto’s breakout star application processed a smooth $240 million in trading volumes without a hitch.

It’s an impressive feat for a dapp that is mostly onchain, representing perhaps one of crypto’s first “mainstream” tests.

Polymarket is designed as a “binary limit order book” (BLOB), a kind of hybrid-decentralized model that is common in many DEXs. Matching (i.e. placing limit orders) on Polymarket is offchain, while settlement and execution of trades goes onchain on Polygon’s PoS sidechain.

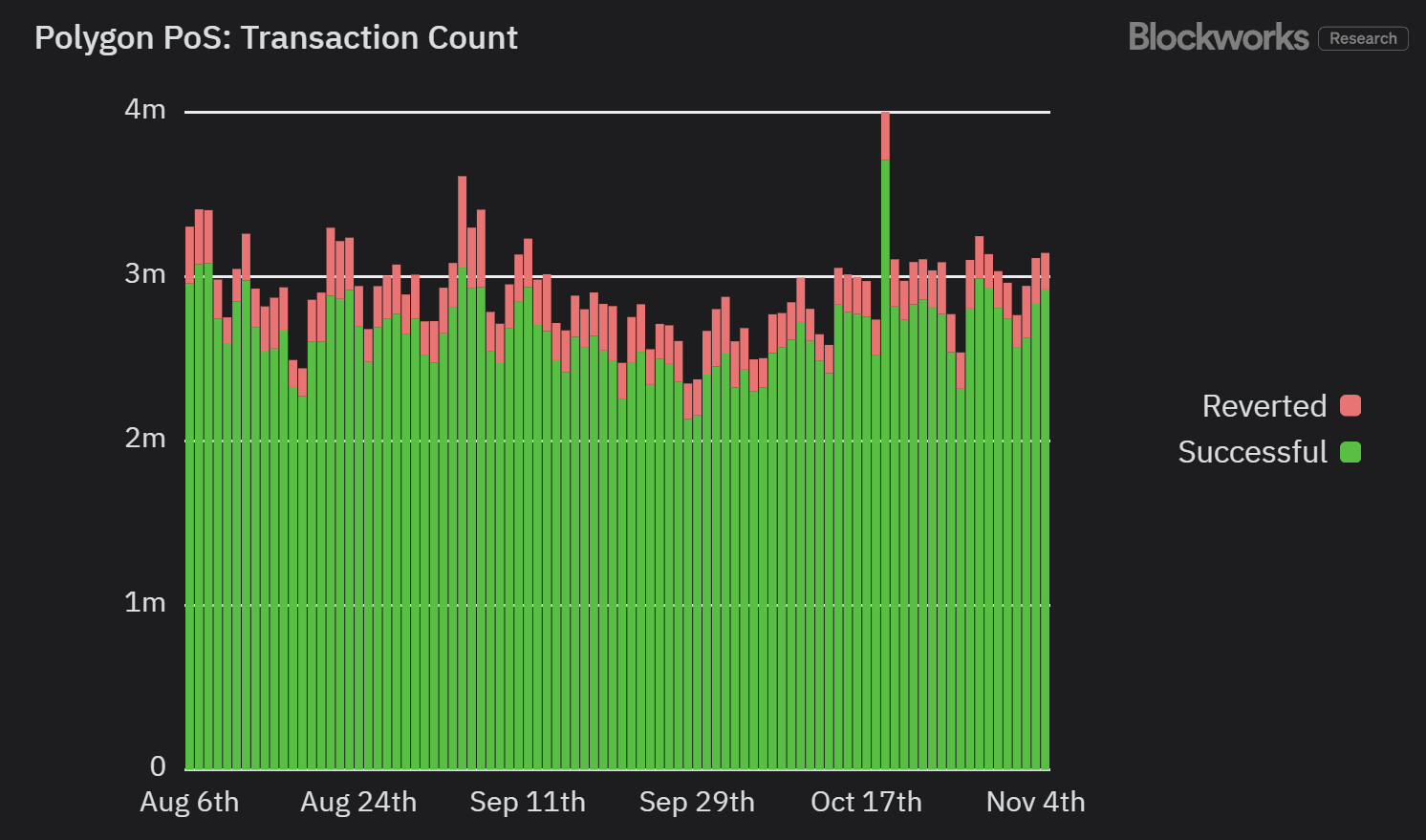

The underlying blockchain chugged along more or less smoothly, processing 2,921,668 transactions on election day, or about 33.8 TPS at a 7% reversion rate, Blockworks Research data shows.

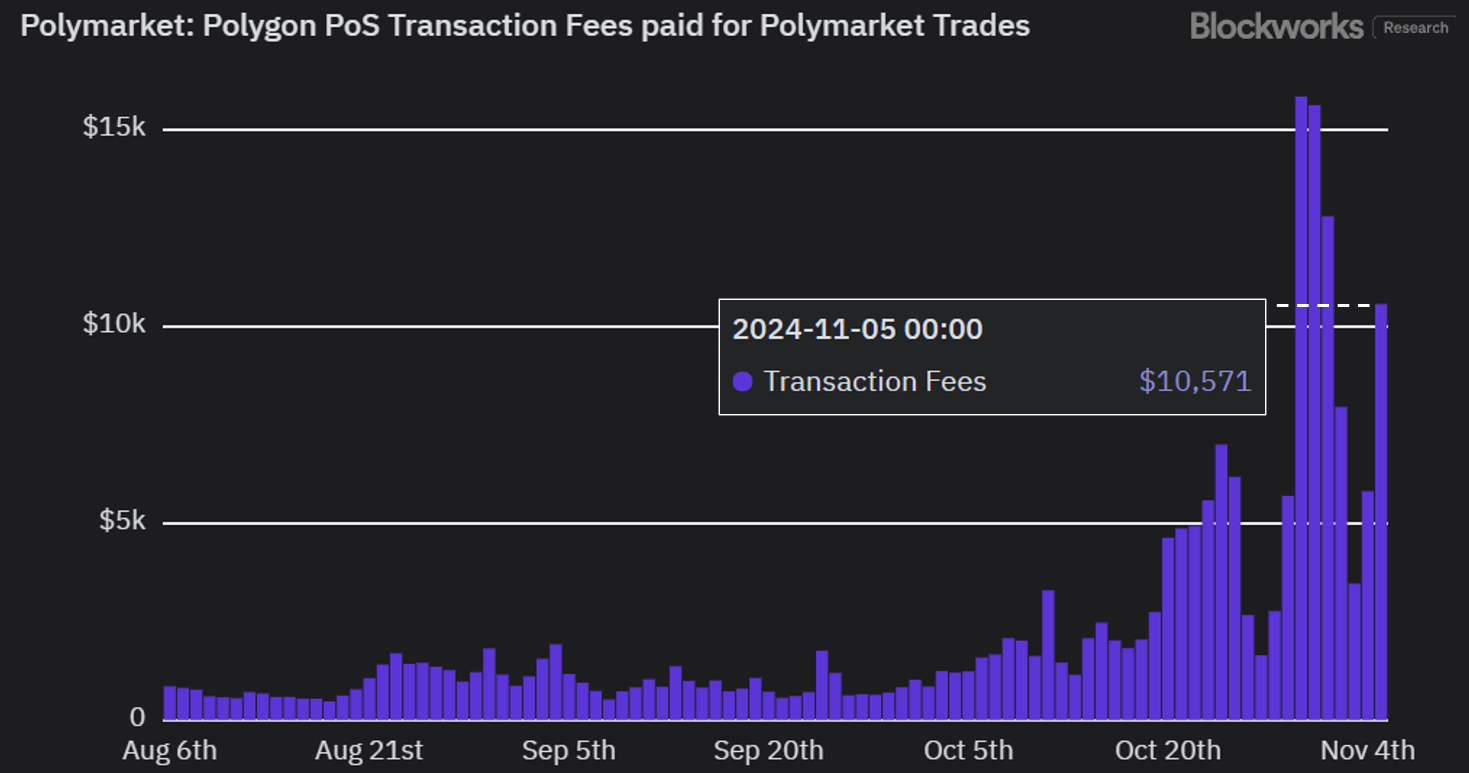

Polygon is taking many well-deserved victory laps, but what’s not talked about is how little value has accrued to its POL token despite Polymarket’s success. On election day alone, Polymarket users generated a pretty minor $10,571 in fees for Polygon.

The price of POL (previously MATIC) is up 7.2% on the day at $0.3, but still down about 54% year to date.

This is not a knock on Polygon; Polygon’s sidechain design was aimed at delivering ultra-low fees at a time when L2s were still relatively scarce.

Polygon’s bet on POL’s value accrual is aimed at the token’s utility in staking for various different Polygon-related services like block batching in the Agglayer, or providing data availability within its Staking Hub/Layer in 2025.

The plan is also to let POL stakers derive fee revenue from other Polygon CDK chains within its aggregated network of blockchains.

But back to Polymarket — where does the prediction market go from here?

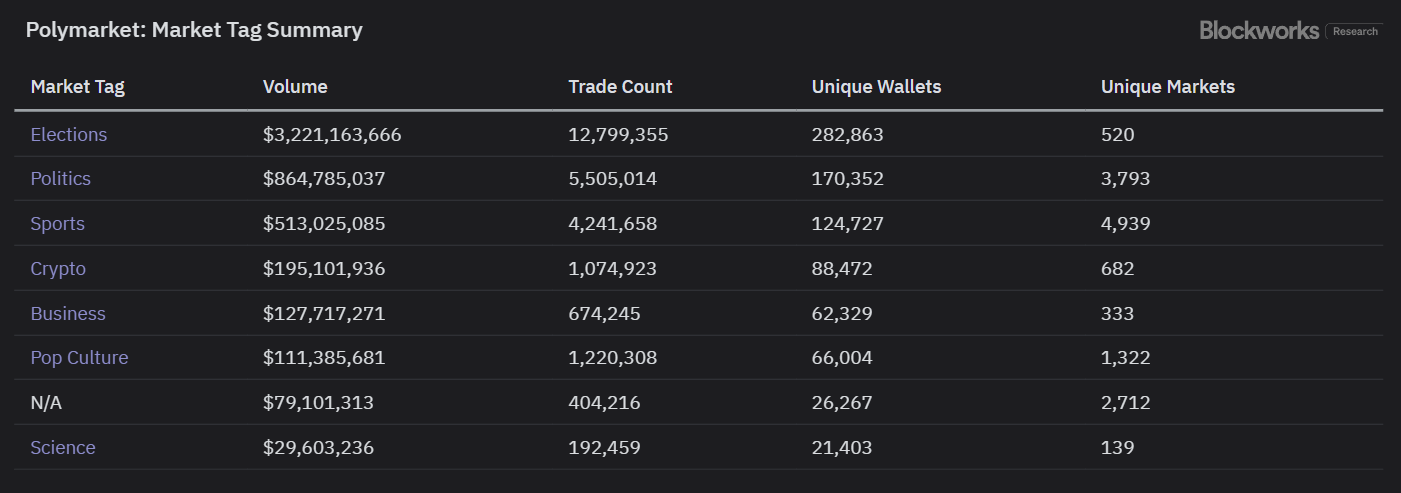

The majority of Polymarket’s usage comes from US political elections. Post-election, Polymarket’s continued success will have to rely on other areas of interest that can stoke the same kind of mainstream appetite as political gambling.

Sports, which makes up the third-largest category of open interest on Polymarket, is one possible demand driver, but that area of gambling is also saturated with existing crypto players like Shuffle, Gandom, Rollbit, Stake.com and more, as well as a slew of Web2 offerings.

For more on Polymarket’s next steps, plug into the latest 0xResearch podcast.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.