The state of Union: Mainnet, momentum, and the path to global interop

Where Union stands today, why mainnet represents a significant leap forward, and what’s up next in its mission to deliver interoperability

Union and Adobe Stock modified by Blockworks

Interoperability has always been crucial to crypto’s future. With Union, it is finally becoming practical at scale.

While interoperability’s importance is widely agreed upon, solutions to date have largely fallen short. Fragmentation continues to silo ecosystems. Insecure bridges remain points of failure. Too many users and developers are forced to rely on centralized third parties to move assets across chains.

Union’s response comes in the form of a secure, hyper-efficient messaging layer that brings trustless interoperability to any chain. By combining consensus verification with zero-knowledge proofs, the protocol offers security, speed, and scalability that existing interoperability offerings cannot match. Where most bridges are capped at connecting around a hundred or so chains, Union can scale to thousands.

With Union mainnet now live, realizing the core team’s vision truly begins. This recent landmark milestone lays the foundation for a future where all chains—from EVM to MoveVM to BitVM to IBC—can connect seamlessly. And the timing could not be more optimal. In moves like Circle’s Arc initiative, the industry’s biggest players have been actively doubling down on crosschain strategies.

In this article, we’ll walk through where Union stands today, why mainnet represents such a significant leap forward, and what’s coming next in its mission to deliver interoperability without compromise.

Tech, traction, and momentum

Union is a zero-knowledge-based messaging layer purpose-built for secure, trustless interoperability across all chains. With mainnet now live, it enters the market as a breakout project already carrying respectable traction, ecosystem alignment, and narrative clarity.

Leading into the full-scale launch, $48 million was already secured on Union’s alpha mainnet (with 98% of it being transferred into the Babylon ecosystem), 325 million testnet transfers were completed, and the protocol completed a record-breaking Groth16 Trusted Setup Ceremony with 5,866 contributors—the largest in history. Across testnet, Union supported 12 networks, with the alpha mainnet application connecting four. Now that mainnet is live, that number will quickly expand.

On the user side, more than 420,000 people have engaged directly with the Union Dashboard across 3 million wallets, while its community footprint has expanded to over 663,000 followers across official and partner channels. Union’s Kaito Yappers campaign drew in 6,700 active participants, helping the project consistently rank among the top 10 pre-TGE projects on Kaito.

Protocol integrations have also played a central role in building momentum. Union’s architecture is already connected to major ecosystems, including Ethereum, Babylon, Sei, Berachain, Arbitrum, and BNB Chain, with Base and Sui slated to join shortly.

That growth is matched by an emerging developer ecosystem. Through its Foundation grants, Union has funded projects like Escher, Fluton, and Dextr.

Meanwhile, the most recent nine-week cohert its Union Fellows program, which evolved from Union’s U Combinator incubator program, drew 50 teams, culminating in the selection of Fellows that now receive hands-on support from the Union core team. Their projects span Bitcoin, DeFi, AI agents, commodities, and more, including the builders behind Esprezzo, Ensemble, Conduct, Nativerse, Thema, Hyperweb, and Sphinx. Collectively, these teams have launched multiple testnets, raised around $10 million in early-stage funding so far, and forged trading partnerships with firms managing billions in AUM.

Rounding out the picture is Union’s organizational progress. The core team has remained deliberately lean since its $12 million Series A, which built on an earlier $4 million seed round, adding only a few new full-time contributors. It’s an approach that stands in contrast to the crypto company status quo; typically, financial raises are followed by hiring booms. Many times, these end in hiring busts as roadmaps and market conditions change. Union’s reserved hiring process is indicative of a team that is wisely adding only needed contributors, opting for sustainability over personnel volatility.

With proven adoption, established integrations, and a developer ecosystem already taking shape, Union enters mainnet with the kind of momentum and organizational health that positions it for long-term, consistent progress.

Launching mainnet & U

Union’s mainnet launch marks the moment when the protocol becomes accessible to all as a live interoperability layer, secured by its native token, U. More than a technical milestone, the launch coincides with the TGE of U, introducing the asset as the economic engine of the network.

U is at the center of the Union network’s design. As the gas token of the Union Dynamic Fee Market, it powers proof verification, relayer activity, and crosschain messaging. It also secures the network through Proof of Stake, with validators and delegators staking U to validate zk-proofs and produce blocks. Beyond these roles, U anchors governance: tokenholders shape protocol direction through Union’s Crosschain Governance system. With liquid staking available via Escher Finance, holders can stake and delegate from any connected chain while maintaining capital efficiency through the liquid staked token eU.

To support mainnet, Union has rolled out a new user interface at app.union.build, which will serve as the primary entry point for crosschain activity. The Union Explorer, Orbital, and Clients modules have also come online, providing a full dashboard for monitoring, interacting with, and building on Union.

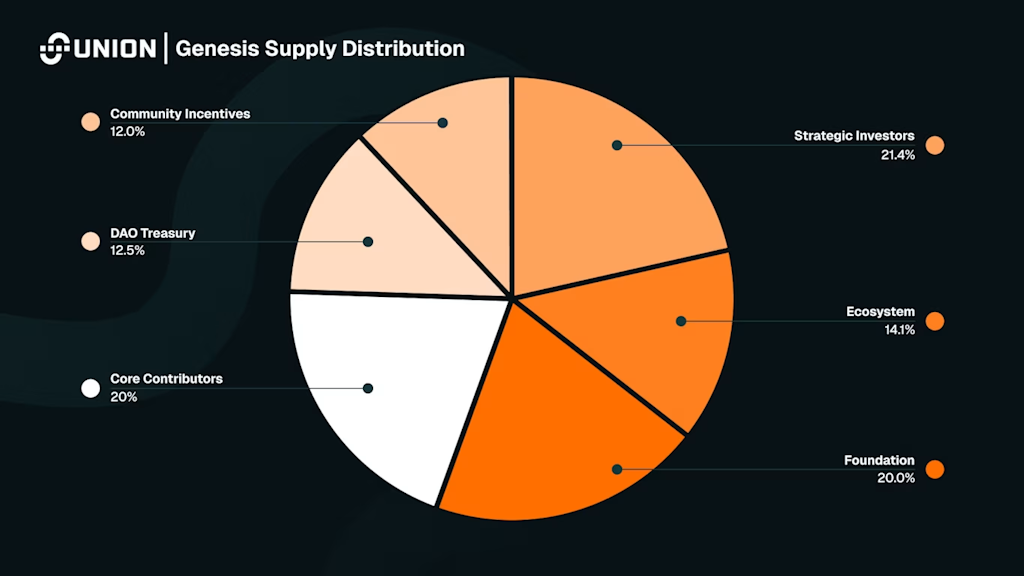

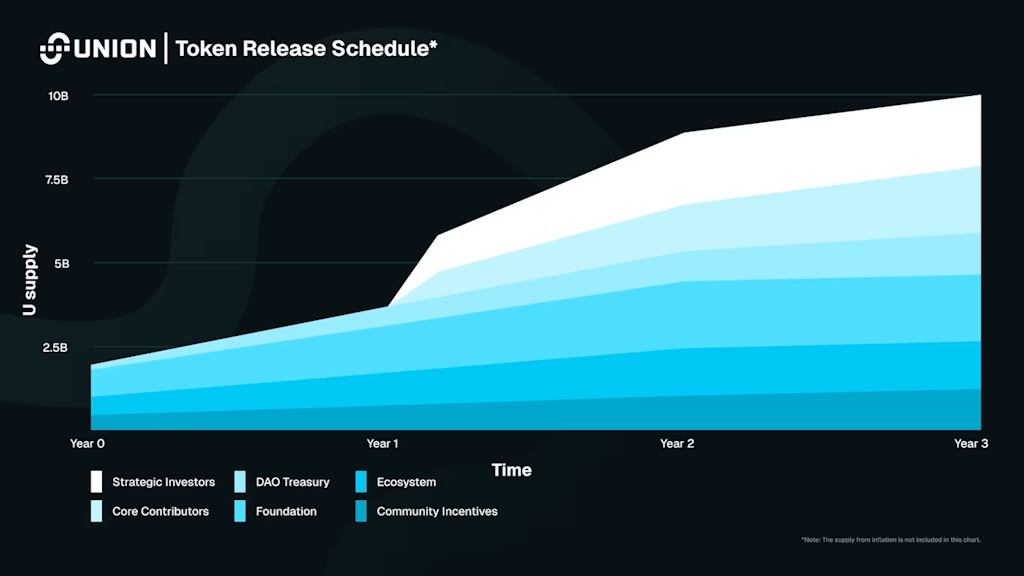

Token incentives are designed to accelerate adoption. 4% of the total supply has been allocated to a genesis drop for early users and contributors, while another 8% is reserved for future seasonal community incentive programs. In parallel, Union is launching a boosted staking vault in partnership with Tower DEX, offering early stakers estimated yields of 120–140% in the first six months, with liquidity routed through Escher’s liquid staking contracts and crosschain vault strategies.

Union’s tokenomics are built for sustainability. Locked tokens from core contributors and investors will be staked to secure the network, with rewards recycled back into ecosystem growth. This ensures that incentives remain community-oriented while strengthening security from day one.

With its token now live, a governance system in place, and a clear roadmap for adoption, Union begins mainnet as more than an interoperability protocol. It launches as a fully aligned network, powered by an economic model designed to scale with demand for secure, trustless interoperability.

To learn more about U, read Union’s introductory blog.

The road ahead: Q4 2025 and beyond

Union’s post-mainnet phase will prioritize expanding the ecosystem, deepening strategic partnerships, and cementing its position as the leading zero-knowledge interoperability layer for global settlement and asset issuance.

In expanding the ecosystem, Union is onboarding additional EVM chains, integrating MoveVM environments, and extending into BTCfi through initiatives like Auro BTC, its forthcoming Union-native Bitcoin liquid staking token. Integrations with BNB Chain, Base, Berachain, Sui, and Sei are progressing toward mainnet, with Solana, Polygon, Aptos, and others in the pipeline. Governance will mature in parallel, moving from council oversight to token-based, crosschain voting systems.

Looking into 2026, the roadmap is structured around three priorities: scaling the ZK architecture, expanding chain connectivity, and advancing governance toward full decentralization. Technical upgrades including sub-second proof generation, GPU/ASIC acceleration, and distributed proving markets are underway to reduce latency and increase throughput.

Union is also extending into financial infrastructure. Upcoming milestones include new DeFi components such as solver aggregators and privacy-preserving AMMs, improved developer tooling, and expanded asset issuance standards. These efforts will contribute to positioning Union as (in addition to being an interoperability protocol) a settlement and liquidity hub for the broader crosschain economy.

To learn more about what’s next, review Union’s roadmap.

Interop without compromise

With mainnet live, Union enters its next chapter with clarity of purpose: to demonstrate what is possible when interoperability is built without compromise. Its foundation is principled, rooted in decentralization, security, and flexibility for every chain.

From here, Union will lean further into settlement and asset issuance, evolving beyond a messaging protocol into a foundational layer for seamless, trustless interoperability at scale. It is positioning itself as the leading ZK interoperability L1, enabling both liquidity and settlement for protocols and asset issuers across the multi-chain economy.

To keep up with Union’s progress, explore their website and follow the project on Union’s X.

This content is sponsored and does not serve as an endorsement by Blockworks. The veracity of this content has not been verified and should not serve as financial advice. We encourage readers to conduct their own research before making financial decisions.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.